Carried forward C/F balance and brought forward B/F balance plays an integral part in the consistency of an accounting system. These figures ensure that the ledger books of a company are accurate and consistent.

Apparently, the closing or balancing figure of a trial balance does not seem a difficult entry. However, these are important figures when closing accounts or reconciling account balances for a business.

Let us discuss what is carried forward and brought balances and their importance.

Balance Brought Forward B/F – Definition

The abbreviation or notation “B/F” refers to “Brought Forward” in accounting terms.

It is written at the top of trial balances in a T-account or any other form of journal entry. It is the carrying balance for a ledger account from the previous accounting period.

The brought forward balance can be from one page of the ledger book to the next as well. However, most commonly, the B/F term is written at the top of a ledger account before writing new entries.

Every business can set its own ledger balancing frequency. For instance, a cash account must be balanced daily after closing business operations.

This account will show some value as an ending balance (C/F), which is then written on the opening line of the new day ledger page.

Balance Carried Forward C/F – Definition

The abbreviation “C/F” refers to “Carried Forward” in accounting terms.

In accounting, every trial balance or ledger account has a closing balance. If that account needs to be carried forward to the next accounting period, the ending balance must not be closed there.

That balance is “carried forward” to the next accounting period.

Similar to the B/F, a balance C/F also represents the balance for one accounting period or one page of the ledger book.

Opening Balance and Closing Balance

Opening balance refers to the debit or credit balance brought forward from the previous accounting periods. Opening balance can also be a new line item in a new ledger account or at the inception of a business.

The closing balance is the debit/credit or positive/negative balance of each trial account in a ledger. It is the amount that is carried forward to the next accounting period.

A closing balance becomes the C/F balance on a ledger. Similarly, the opening balance means B/F from the previous accounting period or ledger page.

The only difference between a B/F and an opening balance is that a B/F balance always comes from a previous accounting period. Conversely, an opening account balance can be written for a new ledger account or a new business.

Similarly, a closing balance for a ledger account does not always get carried forward. Only continuous ledger accounts such as accruals, cash accounts, etc. are carried forward to the next accounting cycles.

Balance Brought Down and Balance Carried Down

Balance brought down (B/D) is an alternative accounting term used for the balance brought forward B/F. It is the account balance that is carried down to the next ledger page or the next accounting cycle.

Similarly, balance carried down C/D is an alternative accounting term used for the balance carried forward C/F.

In a ledger account, if the credit balance is greater than the debit balance, the C/D balance is written on the debit side. The differential amount is the carried down balance that also becomes the brought down B/D balance for the next ledger page.

Examples of Balance B/F and Balance C/F

Let us consider a few simple working examples to understand the concept of balance B/F and balance C/F.

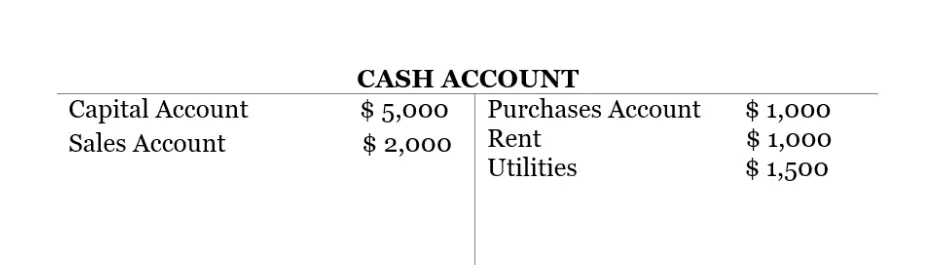

Suppose a company ABC has the following cash account balance in its ledger book.

When ABC company will close this T-account, it will need to balance both sides. The adjusting entry will be the balance carried forward from this cash account for the next accounting cycle.

The C/F entry will be recorded to balance the cash account as:

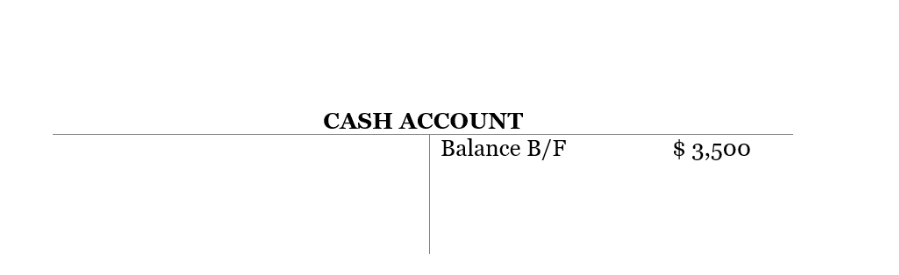

When ABC company begins working for the new day or enters new entries to this cash account, the balance C/F becomes the balance B/F.

The balance brought forward B/F for the next accounting period will be shown as:

ABC Company will enter subsequent entries for the next account activities as and when performed. The carried forward balance may change from credit or debit balance or vice versa from one accounting period to the next.

Now we will consider another working example that shows the ledger balance of a company ABC for one accounting period.

| Account Name | Debit | Credit |

| Cash Account | $ 20,000 | |

| Purchases | $ 30,000 | |

| Accounts Receivable | $ 50,000 | |

| Accounts Payable | $ 60,000 | |

| Salaries | $ 80,000 | |

| Bank Account | $ 100,000 | |

| Totals Carried Forward C/F | $ 170,000 | $ 170,000 |

These carried forward balances will become the brought forward balance for the next account period and will be shown as:

| Account Name | Debit | Credit |

| Brought Forward C/F | $ 170,000 | $ 170,000 |

| Cash Account | – | – |

| Purchases | – | – |

| Accounts Receivable | – | – |

| Accounts Payable | – | – |

| Salaries | – | – |

| Bank Account | – | – |

| Totals Carried Forward C/F | – | – |

Steps to Write Balance B/F and Balance C/F

The closing balance of a trial balance account can be carried forward or carried down to the next page. The first step is to determine whether the account balance needs to be carried down or closed down permanently.

Next, the accountant will enter the relevant transactions on a trial balance’s debit and credit sides. For a single account, the ending balances on both sides may not balance.

Thus, an adjusting entry for a credit or debit will balance the amounts.

If the credit side of a trial balance is greater than the debit side, it will need an adjusting entry on the debit side and vice versa. This adjusting balance is the carrying forward or carried down the balance of that trial balance account.

Finally, when the accountant begins a new ledger page or a new accounting cycle, it will enter the same amount as brought forward B/F balance.

This way, the ledger continues with recurring C/F and B/F amounts.

The total amounts from a ledger account for a company should always balance. These closing balances are carried forward to the next accounting period as brought forward balances.

Importance of Balance Brought Forward and Balance Carried Forward

Modern accounting software may not show the abbreviations of balance B/F and C/F. However, the concept is still in use practically.

Carried forward and brought balances to ensure the accuracy of the ledger accounts of a company. Ledger books then form the basis of the financial statements of a company.

It means the balance C/F and B/F play an important role in the accounting accuracy of the financial statements of a company.

Apart from accuracy, C/F and B/F balances are important for consistency. Trial balances can be balanced with an adjusting entry for the differences that show a credit or a debit balance for a trial balance account.

C/F and B/F balances are also important when an accounting setup transfers from one system to another. Also, these figures are helpful in closing entries for one accounting period, specifically at the year-end closing.