One significant type of expense that an entity often incurs is the prepaid expense. To keep the accounting books accurate and up-to-date it is important to know how to record such expenses. This article is all about prepaid expenses, common examples, and most importantly, the steps to record them.

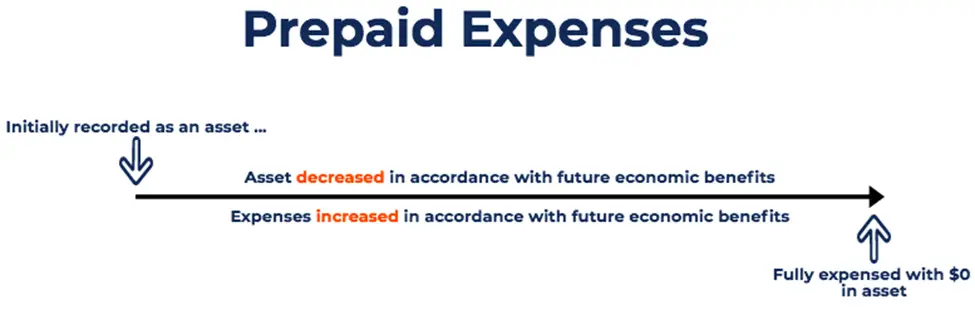

Prepaid expenses are the future expenses paid for goods or services in advance. They do not provide the benefits right away but rather over time in multiple accounting periods. In an accrual accounting system, their entire value is not expensed in one go but a part of it expires when used by the entity.

Small, medium, and large entities alike use prepaid expenses for their day-to-day operations. Some of the most common examples include insurance, rent, interest paid, taxes, and leasing office equipment. Prepaid expenses or expenses paid in advance are first recorded as assets, but where?

On the balance sheet, under the assets section.

But why? Using the accrual accounting method, expenses are only recognized when incurred regardless of payment made. It is also important to understand that prepayments fulfill the definition of assets as per the accounting standards.

For instance, prepaid expenses promise future economic benefits and the value can be reliably measured. Hence, they are recorded as an asset because the business has not yet realized the value of the service or goods when payment was initially made.

These expenses are then turned into expenses once the benefits are realized. As the entity utilizes the asset its value decreases and it turns into an expense and is recorded on an income statement – this process is termed amortization which is an important step to record the prepaid expenses on the books of accounts.

Some people also confuse prepaid expenses with accrued expenses. However, there is a significant difference between these two. All kinds of prepaid expenses are recorded as an asset on the balance sheet as mentioned earlier but the accrued expenses are the current liabilities.

Another key difference is, that the prepaid expense is all about an advance payment for a good or service that will be bought or availed in the future.

On the other hand, in the case of accrued expense, it is a cost that has been incurred by the entity but has not yet been paid. There also remains confusion between prepayment and deposit. While in the case of deposit the payer/entity remains the owner but the scenario is the opposite in the case of prepayment

Let’s take an example to further clarify how prepaid expenses work. Assume ABC company limited has paid a 6-month insurance premium for coverage of the company’s vehicles in advance. The prepayment will be recorded as prepaid insurance as a current asset on the balance sheet.

When ABC company limited utilizes a part of it (i.e. 1/6th in the first month and so on), it will be recorded as an insurance expense on the income statement. While the remaining balance will still be prepaid in the prepaid insurance account.

STEPS TO RECORD PREPAID EXPENSE

Always KEEP IN MIND! We debit an increase in expenses and assets. While the decrease is credited in both cases. Recording a journal entry for prepaid expenses involves the following steps.

STEP # 1: First of all, the entity has to fully pay the expense. To record the full amount of prepayment a simple journal entry is made where we have to debit the prepaid expense account as it is an asset for us as discussed earlier and an increase in the asset is always debited.

Besides, in a double-entry system, there should also be a credit entry for every debit entry. So, we will credit either cash or bank account (cheque) for prepayments, whichever is used to make the payment. Crediting cash or bank account shows a decrease in the asset. This journal entry should look like the one below.

| Date | Particulars | Dr | Cr |

| XX/XX/XXXX | Prepaid Expense | $XX | |

| Cash | $XX |

STEP # 2: The second step is all about amortizing the prepaid expense account for the consumption over time. With amortization, the prepayment will be gradually zero following the concept of the amortization schedule.

The expense is transferred from the balance sheet to the profit & loss statement for the specific period for which the entity uses the accrual. We will credit the prepaid expense account and debit expense account as shown below.

| Date | Particulars | Dr | Cr |

| XX/XX/XXXX | Expense | $XX | |

| Prepaid Expense | $XX |

STEP # 3: Continue step 2, adjusting entries until the entity fully utilizes the prepaid asset and the balance should be $0 at the end in the prepaid account.

EXAMPLE # 1: Say an entity LMN & Co. buys a one-year insurance policy on 1st May 2020 for the equipment that costs $3,000. Bear in mind, that the payment was made in cash upfront.

| Date | Particulars | Dr | Cr |

| 01/06/2020 | Insurance Expenses | $250 | |

| Prepaid Insurance | $250 |

It means a prepayment of $3,000 to the insurance company will be made covering the insurance premium for 12 months.

Referring to step 1 the bookkeeper will debit the prepaid insurance account and credit cash with the full amount paid.

Referring to step 2, an adjusting entry is to be made at the end of each month for one year. The bookkeeper will adjust the accounts for a part utilized by the company i.e. $3,000/12 = $250 a month.

The prepaid insurance account will be credited and insurance expenses will be debited. This process will be repeated until the prepayment ($3,000) is fully utilized.

| Date | Particulars | Dr | Cr |

| 01/05/2020 | Prepaid Insurance | $3,000 | |

| Cash | $3,000 |

EXAMPLE # 2: Let’s look at another example of prepaid rent but by cheque this time. Assume Company X has taken a warehouse on lease for one year with a $10,000 monthly payment. The landlord requires to make the initial payment on 1st August 2021 by cheque. How will the bookkeeper record it?

The bookkeeper of Company X will record the initial payment as below. As the monthly payment is $10,000, the overall prepayment will be $10,000*12 = 120,000. Be noted bank account represents the payment by cheque.

| Date | Particulars | Dr | Cr |

| 01/08/2021 | Prepaid Rent | $120,000 | |

| Bank account | $120,000 |

However, at the end of each month, the bookkeeper of Company A will adjust the books by $10,000 as the entity would have used up 1/12th part of its lease agreement.

The prepaid rent account which was treated as an asset account earlier will now turn into an expense account and will be a credit to decrease the balance.

| Date | Particulars | Dr | Cr |

| 01/09/2021 | Rent Expense | $10,000 | |

| Prepaid Rent | $10,000 |

- Effect Of Prepaid Expense On Financial Statements

The initial entry for the prepaid expenses will have no effect on the financial statements of an entity. It will neither change the profit & loss statement nor the balance sheet.

The prepaid rent/insurance account and cash/cheque in the above examples are asset accounts. With their zero net effect, the balance sheet will not increase or decrease.

However, the adjusting entry may impact the financial records of the company significantly. From the above examples, the expenses will be shown in the profit & loss statement while prepaid rent/insurance will reduce the assets on the balance sheet.