Definition:

The audit opinion refers to the statement issued by an auditor expressing the examination results on their clients’ financial statements. The audit opinion is crucial for the company’s stakeholders because it provides critical information concerning their financial statements. It lets an organization’s stakeholders determine whether their financial statements are correct or wrong.

The opinions made by the auditors provide a basis for the stakeholders to make critical decisions for their organization’s success. It indirectly provides information on the integrity of the organization’s management and directors to the users of financial statements.

If the auditors use international standards in the auditing process, then ISA 700 principles are used to form an unmodified opinion (Puspaningsih & Analia, 2020). ISA 705 on the other hand, is the guideline used by the auditors when forming a modified opinion based on their audit findings.

According to international standards, auditors should give their opinion on the financial statements of the client. The auditor’s view should show whether the financial statements are prepared in all material respected and in compliance with the accounting framework (Puspaningsih & Analia, 2020).

If the organization has prepared its financial statements according to these requirements, the auditor forms an unmodified opinion.

However, if the facts presented in the financial statements are questionable, auditors should use ISA 705 to form audit opinions based on the problem in their reports.

Generally, audit opinions are classified into two; modified and unmodified. This paper discusses different audit opinions, including unmodified opinions and other sub opinions classified under modified audit opinions.

Types of Audit opinions

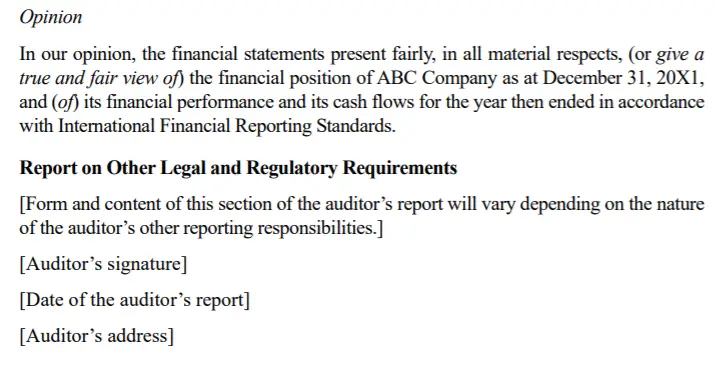

1) Unmodified Opinion:

The modified opinion is formed when the company’s financial statements are prepared according to accounting standards and are in all material respect. It is a type of opinion that is expressed if the auditor has gathered enough and correct evidence from the company’s books of accounts (Puspaningsih & Analia, 2020). The auditors arrive at an unmodified opinion after testing the financial statements of their clients.

However, auditors do not provide the company with total assertion on its financial records. This is the reason why the words “in all material respect” are used. The “in all material respect” words are used to mean that in auditing, there is no material misstatement in the company’s financial records (Payne & Williamson, 2021). Auditors should always refer to ISA 700 to form an unmodified opinion.

The other type of audit opinion is modified opinion, classified into three categories as explained below. These are types of opinions that the auditor issues to the company if its financial reporting is done per the entity’s accounting standards.

However, the auditor can only issue a modified opinion if the entity’s financial statements do not present in all material respect per the firm’s accounting framework. Below are three types of modified audit opinions that auditors may form after finding that a firm’s financial statements are pervasive and have material misstatements.

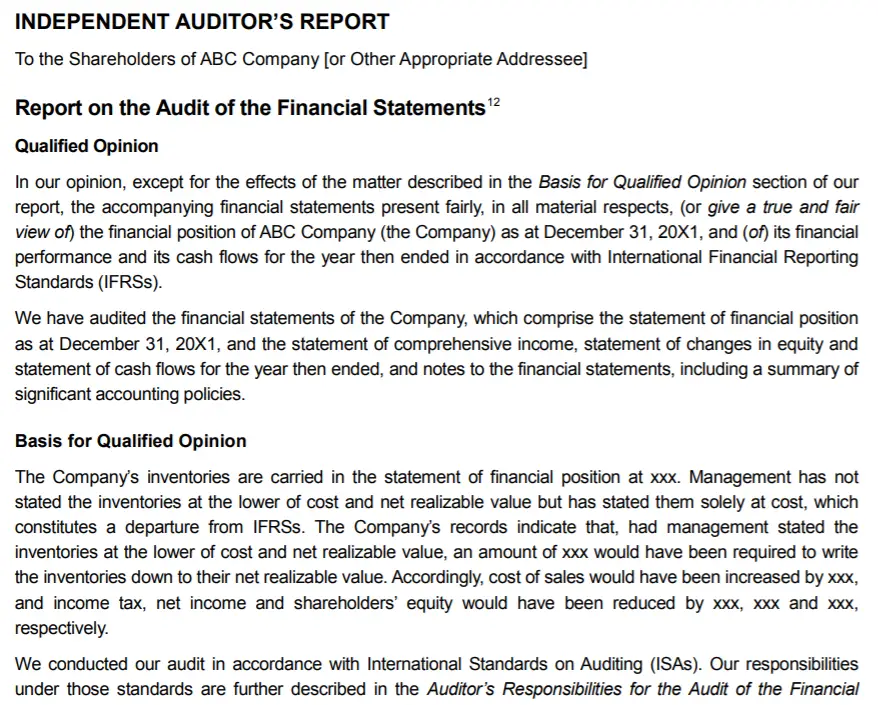

2) Qualified Opinion:

The qualified opinion is an opinion formed after testing and confirming that there are material misstatements in the entity’s books of account. In the auditor’s opinion to be qualified, the identified misstatements must not be pervasive (Payne & Williamson, 2021). In this case, pervasive misstatements are a bit subjective depending on the judgment issued by the auditor.

A misstatement is pervasive if it does not influence the financial statement users’ financial statements and decisions (Puspaningsih & Analia, 2020). The auditor might issue this opinion at the opening balance of the financial statements if a different auditor did the audit of the previous year. A qualified opinion is more serious than an unqualified opinion. However, it is usually better than disclaimers and adverse opinions.

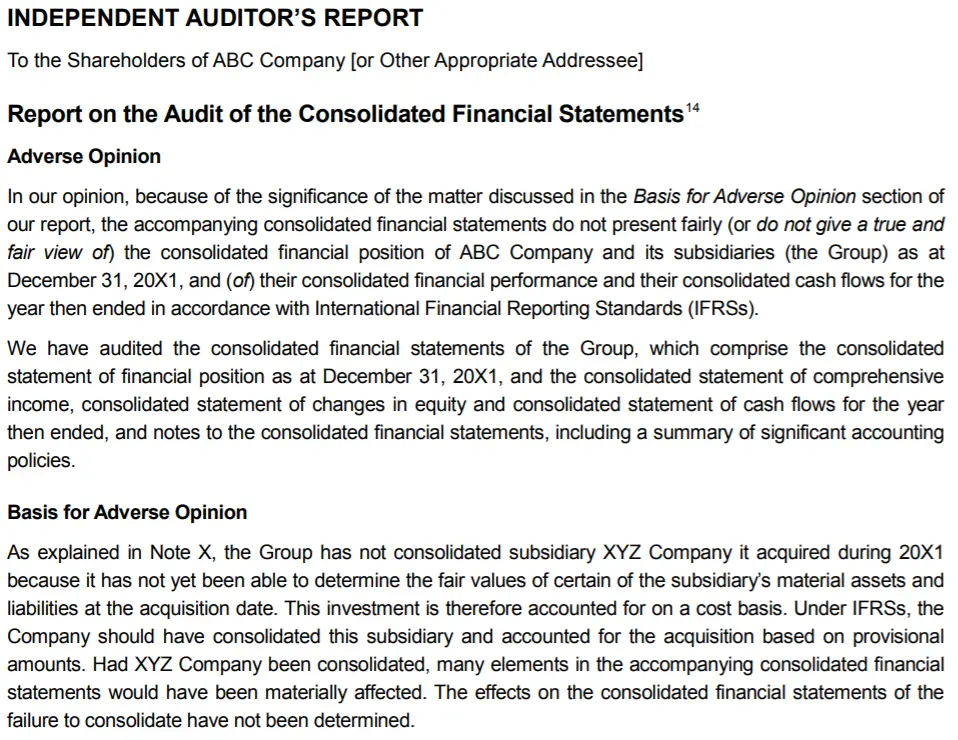

3) Adverse Opinion:

This is a negative opinion formed by an auditor on the company’s financial records. For auditors to form this type of opinion, they must have examined and identified a material misstatement in the financial records (Berglund, 2020).

The financial statements are therefore considered to be pervasive. An adverse opinion is more serious as compared to a qualified opinion (Berglund, 2020). It is an important opinion to users of financial statements because it influences their decisions regarding the business entity.

The difference between a negative opinion and a qualified opinion is that a qualified opinion has only material misstatement but is not pervasive as an adverse opinion.

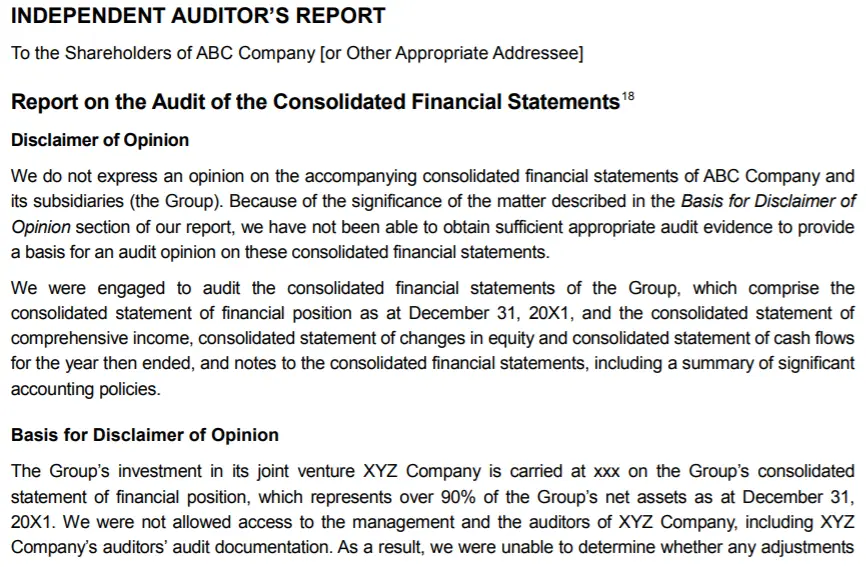

4) Disclaimer of Opinion:

This is a condition opinion that is formed by the auditors after examining the entity’s books of account. It is usually different from adverse and qualified opinions. In this opinion, auditors issue an opinion because they could not gather enough evidence on material items.

Disclaimer opinion arises when the auditors could complete their testing due to inefficient evidence (Payne & Williamson, 2021). Auditors believe that the things they could not access could have material information that would affect their opinion.

Usually, a disclaimer opinion arises after the auditors have tried to negotiate with the client to provide them with important information, but the client rejects the request (Payne & Williamson, 2021). Whether the client’s decision to reject the auditors’ request to provide full information is intentional or unintentional, the auditor issues a disclaimer opinion.

Conclusions

The financial statement analysis helps the auditors to conclude different aspects. The findings made by the auditors should be independent and factual. The responsibility of the auditors to form an audit opinion is based on the contents of the audit reports.

This is because audit reports address the results of an audit of the entity’s financial records. The engagements of the summary of financial statements to form the opinion apply when the auditor engages the audit report separately in the financial statement analysis.

The auditor is required determine whether the financial records are accurate and reflect a fair view in all material aspects. The opinion depends on the financial standards. The auditors need to evaluate and consider the qualitative factors of financial reporting framework.

This would help the auditors give the best opinion considering possible bias indicators in the organization’s judgments. In all audit opinions, an auditor must express a true and fair view of the entity’s operations. The opinions show inform reflect on the integrity of the firm to allow the users of financial statements to make the right decisions concerning the entity.