Overview

Income Tax Audits are often challenging and time-consuming from the perspective of the organizations. This is primarily due to the fact that taxes tend to be increasingly complex for businesses because they need to ensure that they comply with all laws and regulations in order to avoid any penalties from taking place. In this regard, it can be seen that income tax audit can be broadly categorized into two broader categories, which are given below:

- Income Tax Audit by the Tax Collection Authority (IRS)

- Income Tax Paid Audit by the external auditor

In both the scenarios mentioned above, the auditors go through the same protocols, and therefore, the risks, audit assertions, as well as procedures for both are fairly similar. Hence, auditors need to have a clear understanding regarding income tax audits, so that they are able to save their clients from any penalties or restrictions in the coming future.

Risks Associated with auditing Income Tax

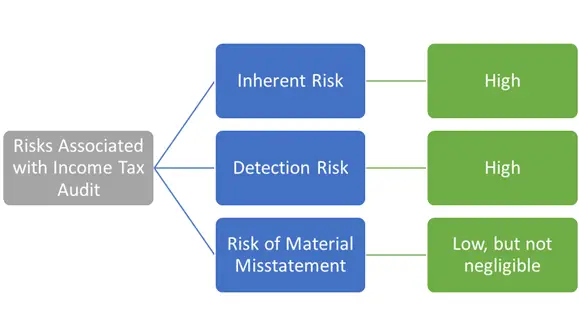

Income Tax tends to be subtracted at the latter part of the financial statement. It is directly contingent on the volume of profit that the company generates. However, there is a high inherent risk associated with auditing income tax. In addition, detection risks, and the risk of material misstatement is also significant and needs to be incorporated in the audit planning phase, as shown below:

Subsequent explanation of these risks is given below.

- Inherent Risk: The inherent risk associated with income tax is considerably higher. This is predominantly because of the fact that the nature of tax in itself is fairly complex. There are several different industry-related rules that are applicable, in addition to the exemptions that the company has faced. Therefore, in order to properly audit the income tax paid, auditors need to have a clear understanding of the industry dynamics, and the relevant tax rates that are applicable. The amount of income tax paid in itself does not really hold a high inherent risk. It is the calculation and subsequent computation of the inherent risk that tends to be increasingly important from the perspective of the auditor.

- Detection Risk: Detection Risk simply refers to the inability of the audit system to point out any errors in the Income Tax. As far as Income Tax audit is concerned, detection risk is also fairly high because of the fact that there are several different components involved that need to be considered in order to check for proper compliance.

- Risk of Material Misstatement: The risk of Material Misstatement in Income Tax tends to below. This is because this amount is directly paid to the government, so verifying that amount does not tend to be a challenge for the auditors. This amount can be easily verified with the Income Tax certificate, and hence, this is a relatively easier part of the Income Tax Audit.

However, the overall risk associated with the Income Tax Audit is high, and this risk can only be minimized if the auditors have professional skepticism as well as sufficient tax related knowledge to ensure that all the relevant criterion have been met by the accountants in the organization.

Audit Assertions when auditing Income Tax

When auditing Income Tax, there are certain assertions that need to be checked against. These assertions mainly form the basis of gauging the extent to which Income Tax has been properly accounted for and paid to the organization. The audit assertions that need to be checked for are as follows:

- Completeness: The audit assertion of completeness refers to the premise that the Income Tax in the organization has been completely recorded and filed. This implies that proper disclosure regarding the Income Tax paid, in addition to the relevant amount paid needs to be incorporated in the financial statements.

- Accuracy: Income Tax that is calculated and recorded in the financial statements should be accurate, and should not miss out on any important elements that might be beneficial from the perspective of the users of the financial statement.

- Existence: Regardless of the fact that this tends to be a really fairly obvious assertion, yet disclosed Income Tax should actually be paid by the organization.

- Classification: This particular assertion refers to Income Tax being disclosed and presented in the financial statements as solely Income Tax. There might be several other taxes that a business might pay over the course of time. It can be seen that they should be classified in a proper manner in order to ensure that there are no classification-related errors.

- Valuation: The assertion of valuation, pertaining to Income Tax refers to the tax rates being applied in a correct manner. Furthermore, it also requires all the relevant taxes to be calculated in a proper manner so that they are correctly paid, and subsequently presented on the financial statements.

- Understandability: The Income Tax calculations should be properly disclosed to the users of the financial statement so that it is comprehendible by the users of the financial statements.

Audit Procedures during auditing Income Tax

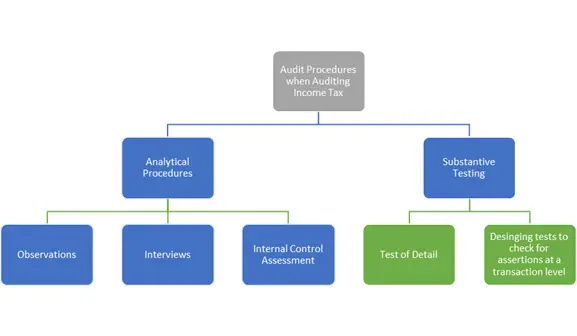

In order for auditors to properly assess the extent to which these assertions have been included in the preparatory fabric of the organization, it is important to ensure that there’s a fair mixture of both, analytical procedures, as well as substantive testing.

Subsequent details of both are mentioned below:

Analytical Procedures Involved with Auditing Income Tax

It is important for auditors to ensure the general working environment of the company helps them to draw important observations pertaining to the state of affairs within the company. This mainly requires them to inspect the level of internal control within the company. Having a stronger internal control helps businesses to ensure that they are preventing themselves from fraudulent related activities in the future.

Analytical Procedures are therefore necessary in order to help devise the substantive procedures. Even if analytical procedures are indicative of a stronger internal control within the company, still the company is supposed to conduct substantive testing in order to make sure that there is no material misstatement in the disclosure of the Income Tax.

Substantive Testing

As mentioned earlier, substantive testing also holds tantamount value in properly determining the extent to which Income Tax has been properly disclosed in the financial statements. The relevant audit assertions, in addition to the substantive tests for details, have been summarized in the table below:

| Audit Assertion | Substantive Testing |

| Completeness | This involves testing that proper income figures are used in order to calculate the Income Tax for the year. Furthermore, it is done by double-checking the relevant income tax rates that are applicable in this regard. |

| Accuracy | Income Tax that is declared needs to be accurate in terms of calculations. There should be no mathematical errors, or errors in computation of the Income Tax for the respective year. |

| Existence | Income Tax disclosed on the financial statement should be double checked and verified with the tax challans, to check if the organization actually accrues (or has paid) the stated amount of Income Tax. |

| Classification | Income Tax should be deconstructed in order to determine if the tax amount is solely for Income Tax, or if it includes a variety of other taxes that have been clubbed under income tax. In the same manner, Income Tax paid for a particular year might differ from Income Tax payable in a current year. This needs to be reconciled from the bank statement as well as tax statements. |

| Valuation | Valuation of Income Tax pertaining to the applicable laws and regulations should be recalculated in order to ensure that there has been no issue in valuing and subsequently declaring these taxes. |