Definition

The process of audit is considered one of the most important aspects of an organization. Auditing financial statements are required by law, and therefore, companies have to hire an independent external lawyer that can help them comply with the required rules and regulations. It is then the responsibility of the external auditor to make sure that they are able to identify the best possible audit strategy to make sure that are able to gather reasonable evidence based on which they can issue an opinion.

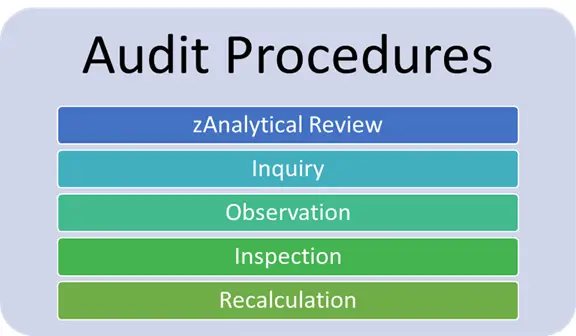

During the audit process, auditors are required to define the audit procedures that will help them execute the auditing job with relative ease. Audit Procedures are used by auditors in order to determine the extent to which the financial statements have been prepared in an accurate manner. The main aspect that they need to gauge is the quality of financial information that is provided by clients so that they can duly express the auditors’ opinion in this regard.

Audit Procedures are therefore set in place in order to test the relevant assertion across transaction types, in addition to the process itself, as well as the reason for testing the particular transaction or account. In order to seamlessly conduct an audit to gather reasonable evidence, it is important for auditors to plan out the process, and have a clear idea regarding the procedures they can use.

Types of Audit Procedures

Given the fact that audit in itself is a considerably cumbersome task, it needs to inculcate a wide variety of tasks and objectives to ensure that there is no stone left unturned in gathering reasonable evidence on the basis of which auditors can issue their statements accordingly.

Therefore, these audit procedures are used in order to gather substantial evidence. The main types of audit procedures that are commonly used are given below:

All these audit procedures are really important, and they should cover substantial ground in helping auditors reach a substantial conclusion regarding the audit of the stated organization. Subsequent details of these audit procedures are given below:

Analytical Review

The analytical procedure simply requires the auditor to ensure that they are able to analyze transactions that come off as unusual to them. Therefore, in these particular analytical procedures, they are supposed to ensure that all transaction-related balances are properly analyzed in order to pinpoint inconsistent balances or errors. After this preliminary review, other audit procedures are used in order to further gather evidence that can somewhat justify these inconsistencies or list balances.

Inquiry

The audit procedure about inquiry simply requires auditors to ask around in the case where they need some clarity regarding any matter pertaining to the audit. In this regard, the management, as well as the employees are able to cooperate with the auditor in order to make sure that the issues are properly addressed, and the inquiry is answered in a proper manner.

Observation

The audit procedure of observation requires the auditors to observe their internal, as well as their external environment in order to ask for substantial questions. In this regard, it is important to ensure that auditors can properly observe the general norm of the industry, as well as the general norm of the organization. The main element that needs to be tested in this regard is pertaining to consistency across all years and formats. Therefore, a lot of the audit work pertains to observation which should also incorporate professional skepticism and total independence.

Inspection

Inspection mainly refers to verification of all the balances, and other related invoices within the organization. It is imperative for auditors to ensure that they are able to back up all the relevant resources to make sure that no information is missed out upon.

Recalculation

Recalculation is referred to as the audit procedure where the auditor makes sure that there have been no mathematical errors in the computation of totals, or list balances. It is important for auditors to ensure that there are no errors in the calculation of bad debts, depreciation, or amortization.

Why are Audit Procedures Important?

There are numerous different reasons as to why audit procedures are considered to be important. These reasons mainly lie in the realms of ensuring that proper ground has been covered in the audit process based on which auditors can issue their opinion regarding the financial statements. The reasons as to why audit procedures are imported are given below:

- It acts as an aid towards audit planning: Since financial year-end audits are considered to be highly crucial, they require an extensive amount of work. Having clarity regarding audit procedures, and how they are going to be used in order to test the audit assertions helps in the audit planning process.

- Audit Procedures are a blueprint in case auditors are stuck – this implies that in cases where auditors are unclear regarding how to test a particular assertion, they can apply all of the relevant procedures in order to get clarity regarding the assertion they are dubious about.

- Audit Procedures help in streamlining the audit process: Audit is a time-consuming task. Audit procedures help to reduce the time that would otherwise be taken in planning. For all the relevant balances and transactions, there is a specified procedure that can be tested for proper clarity. Therefore, these processes help streamline the process, and complete it in a shorter time frame.

Audit Assertions

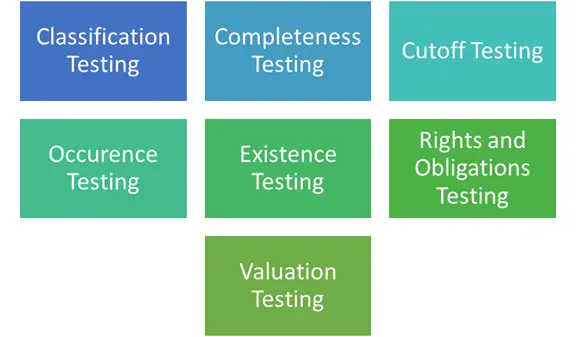

There are several different types of audit procedures that are used by auditors in order to get clarity regarding what needs to be done in terms of determining the best possible course of action.

Factually, either one, or several of these procedures can be used in order to test the required assertions for the particular transaction. The following assertions are tested using audit procedures:

Subsequent explanation of these assertions that are tested in the process is given as follows:

- Classification Testing: The audit procedures should be designed in order to ensure whether transactions are classified in a correct manner in the accounting records. The audit procedure is going to be designed in order to ensure that the assertion of classification is properly tested.

- Completeness Testing: The audit assertion of completeness is tested by designing procedures that help to identify if the transactions that have been recorded are complete in nature.

- Cutoff Testing: The audit procedure must be designed to ensure that a proper cut-off is made pertaining to cutoffs. It is important to ensure that financial statements include lists and balances that relevant to that particular year.

- Occurrence Testing: This is to ensure that the transactions pertaining to sales and expenses have actually occurred within the company.

- Existence Testing: The audit procedure designed to test this particular transaction should focus on assets and transactions to make sure they actually exist on the financial statements.

- Rights and Obligations Testing: The audit procedures must include a protocol to make sure that the declarations that have been made by the organization in the financial statement are actually true, and if the organization holds the legal light towards the declared assets.

- Valuation Testing: Valuation testing is the act of auditors to ascertain that the assets are being valued at correct terms and conditions. It is important to ensure that all accounting principles are followed with proper ease.