Definition:

The auditing process involves the actions and procedures used to control organizational activities. The set procedures are used in testing and proving that corporate operations are conducted effectively (Kinghabaeva & Savicheva, 2021).

They ensure that organizations follow due control mechanisms. However, the audit process helps business organizations to detect opportunities and areas of improvement.

Contrary to what most people think, the audit process involves monitoring and investigating the security and efficiency of the operations of the organization (McCracken & Schmidt, 2018).

It is a procedure that business organizations should use more often because it is effective. The audit process helps in finding organizational bottlenecks and wastes.

As a result, it helps in improving the productivity of the organization.

Usually, the audit process focuses on finding business vulnerabilities and risks to find solutions (McCracken & Schmidt, 2018). This paper provides a quick guide to the audit process that business organizations should use to improve their effectiveness and productivity.

The discussion also focuses more on the critical audit processes.

Audit processes

1) Selection Phase:

In the auditing process, the selection phase involves establishing the organization’s priority areas that need to e audited. Choosing the items to audit should be integrated as part of the organization’s internal audit.

It should also be integrated into the risk management program and annual plan for the organization.

In most organizations, the internal departments also integrate and coordinate with organizational compliance plans and activities (Vaicekauskas, 2019).

When choosing the priority areas of audit managers in collaboration with internal auditors, they should identify critical business processes that need to be audited. To do this, they should break down and rate risk areas within their company.

Secondly, they should also try to understand the availability of continuous data for auditing the identified issues (Vaicekauskas, 2019).

Managers should evaluate the cost and benefits of implementing an audit process for the identified risk areas. When performing the actions identified above, auditors should consider the organization’s audit procedures’ main objectives.

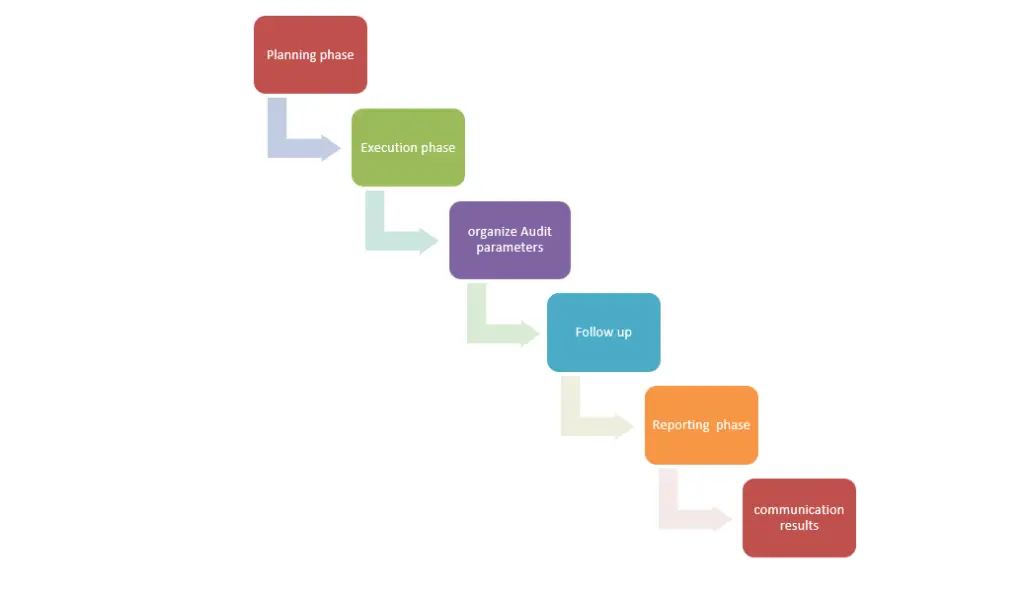

2) Planning Phase:

During audit planning, the internal auditors gather relevant information and initiate contact with the client. The planning phase also involves monitoring audit rules and determining the rules to guide the auditor to carry out an audit activity (McCracken & Schmidt, 2018).

Auditors organize a meeting with their clients to identify potential risks and determine the scope of auditing activities. Monitoring audit and audit rules should always take into consideration of legal and environmental frameworks.

3) Execution phase:

The execution process involved the fieldwork that an audit staff should execute after planning an audit. In this case, the client is informed of the entire auditing process through regular meetings.

Both auditors and clients discuss audit observations, potential audit findings, and recommendations (Vaicekauskas, 2019).

Besides, the execution phase involves determining the frequency of the audit process. Auditors need to think about several factors, including the natural rhythm of the audit process, and processes used in operating the business. However, they should also consider other trained personnel involved auditing process.

4) Organize Audit Parameters:

Auditors should configure rules governing each identified area of an audit before a continuous audit procedure is implemented. Every parameter’s frequency may need to be changed after the first setup based on the change from the audited activity (McCracken & Schmidt, 2018).

Therefore, the initial parameters, rules, and frequency of the audit process need to be changed. They should be defined before the auditor begins the audit process. However, the auditors need to reconfigure the initial parameters and rules based on the activity’s monitoring results.

5) Following Up:

A follow-up parameter is an audit process that relates to the treatment of identified alarms and business errors. The organization needs to determine the parties receiving the alarm, for example, internal auditors, line managers, or both (McCracken & Schmidt, 2018).

In most cases, the notice is sent to the process managers or the managers’ immediate supervisor. When follow-up activity is completed, it should be addressed, especially during the continuous audit process.

The entity should perform follow-up procedures, including reconciling the alarm before the follow-up process (McCracken & Schmidt, 2018). Negotiating the notice involves looking at alternative data sources before performing and establishing auditing guidelines.

6) Reporting Phase:

Reporting is an audit process that involves a summary of the audit findings. It provides conclusions and recommendations for each audit (Kinghabaeva & Savicheva, 2021).

However, the audit findings are communicated to the client through an audit report called a draft report. Reporting phase offers the client a chance to respond to the report of an auditor by submitting an action plan within a time frame (Kinghabaeva & Savicheva, 2021).

The client’s responses are usually included in the final audit report. The auditor should submit these responses to the appropriate management level of the organization.

7) Communicating Results:

The final item in the audit process involves the communication of auditing results to the client. When communicating the clients’ audit findings, it is essential to keep the exchange of results as independent as possible (Kinghabaeva & Savicheva, 2021).

Auditors should ensure that their reports are consistent with the findings of an audit. It is essential to follow the audit process carefully before communicating an exchange with the client.

Besides, organizations must consider implementing follow-up and communication procedures to avoid the risk of collusion.

Conclusion

The audit process involves a careful analysis of organizational activities by a qualified auditor. It helps auditors to draw conclusions and opinions regarding different aspects of the line items of financial statements.

The conclusions drawn by the auditors should be independent and factual. This means that the auditor should carry a free-form bias audit of the organizational activities. The audit opinions and conclusions should be based on facts but not assumptions.

A set of conclusions drawn from facts helps the auditor form an accurate and fair view of its activities. However, the summary of the most critical issues and recommendations on the audit process should be considered in drawing audit conclusions.

This involves describing the most significant problems of the audit and the issues of the audit report itself.