Overview

The year-end audit is often considered to be one of the most cumbersome tasks within an organization. In this regard, it is important for organizations, as well as the auditors, to realize the expansive work involved so that they can prepare for it in an effective manner. When auditing financial statements, auditors are supposed to ensure that they cover sufficient ground for almost all of the major components of the financial statements. This mainly includes the Income Statement and the Statement of Financial Position (Balance Sheet) of the company.

Depreciation is defined as the wear and tear that is incurred on the asset as a result of usage, or time. Therefore, under the accounting law, organizations are supposed to record this as an expense on the Income Statement, and a reduced (carried down value) in the Balance Sheet.

When it comes to Income statements, depreciation expense tends to be one of the most significant expenses that are incurred by the company. Regardless of the fact that it is a non-cash expense, yet it has a massive impact on profitability. Even with the Balance Sheet, depreciation tends to be a highly deterministic factor because it directly impacts the value of the assets on the balance sheet. Since the carrying value of assets can phenomenally change as a result of depreciation, it is highly likely to result in an uninformed decision taken by the investor.

Therefore, auditing depreciation expense tends to be a highly important factor from the perspective of the auditing partner, and hence, it should be audited in a proper manner.

Risks Associated with Auditing Depreciation Expense

Depreciation Expense is an expense for the books of the company. Since it is a non-cash expense, it is supposed to be audited in a more technical manner. Hence, the overall inherent risk of misstatement depreciation is fairly high. Broadly speaking, the risks associated with auditing depreciation can be broadly categorized into two main categories:

- Risk of Material Misstatement: As far as the risk of material misstatement is concerned, it is the risk of the depreciation expense being materially different from the actual depreciation that has been incurred on Property, Plant, and Equipment. Therefore, it is a multitude of two main factors, the inherent risk, and the control risk.

As far as the control risk is concerned, it is fairly low. This is because calculation and recording depreciation are directly under the responsibility of the accountant. With lesser hierarchy involved, the chance of internal control sabotage is quite minimal. However, the inherent risk, on the other hand, is fairly high. This is because there are numerous Fixed Assets possessed by a company. Individually calculating all the respective depreciation might be challenging from the perspective of the company. In the same manner, the calculation of depreciation is a fairly technical task. The chance of error is high, which makes the overall auditing risk of material misstatement high.

- Detection Risk: Detection Risk mainly refers to the inability of the auditor to detect any material misstatement in the amount of depreciation expense. In typical organizational audits, this particular risk also tends to be high because most of these calculations date back to years. Reconciling all these amounts (especially in the case of a new engaging partner) is a relatively tedious job.

Therefore, with overall risk elements of depreciation being considerably high, it is important for organizations to ensure that they are able to fully inculcate these risks when designing their audit procedures, so that that they are able to gather reliable evidence based on which they can give their reasonable assurance pertaining to the disclosures made by the company.

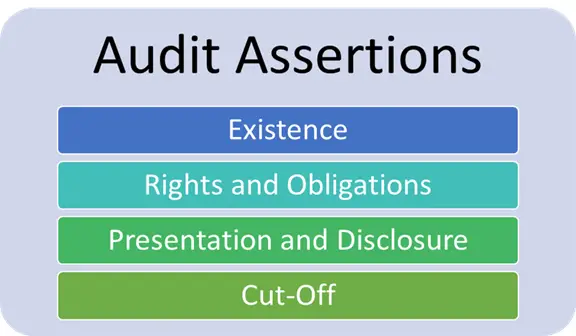

Audit Assertions for Auditing Depreciation Expense

When auditing for depreciation related expenses, there have to be a couple of expenses that need to be included in the analysis by the auditors. These assertions are mentioned below:

Subsequent explanation of these audit assertions is given below:

- Existence: This particular audit assertion states that only those depreciation-related expenses should be included in the financial statements that are actually incurred by the company. Subsequently, only those assets should be depreciated that are allowed to be depreciated by the accounting law.

- Rights and Obligations: This assertion is an important one because it requires only that asset depreciation to be included in the financial statement that is formally and officially owned by the company. In other words, leased assets, or assets that are not owned by the company cannot be depreciated in the financial statements.

- Accuracy: Since depreciation is a fairly technical concept, it should properly be calculated in accordance with the accounting laws. Using proper depreciation principles in order to correctly compute the accounting principles tends to be an important factor that should be ensured under this specific assertion.

- Cut-Off: This assertion states that the only that depreciation should be charged in the financial statement that is relevant to the current year. Only the current year’s depreciation should be charged to the Income Statement (and not Accumulated Depreciation).

Audit Procedures involved in Auditing Depreciation

Since depreciation tends to be a fairly technical matter of audit, it needs to be audited with proper ease. In this regard, it is important to consider the fact that the audit procedures that are designed to audit depreciation expenses are broadly categorized into two main elements: Analytical Procedures and Substantive Audit Testing.

Subsequent explanation for both is given below:

Analytical Procedures

Analytical Procedures are mainly used in order to assess the need to carry out the latter part of the audit in terms of planning, timing, as well as substantive audit testing. It is considered a preliminary audit step that helps to determine the extent to which the matter at hand needs to be audited. When it comes to depreciation, the following analytical procedures are carried out:

- Analytical Review: This particular step is mainly inculcated in order to develop a certain expectation pertaining to the depreciation figures in the organization. This will include auditors making an estimate regarding the depreciation that should be charged on the financial statement, based on the number of fixed assets.

- Observation: Following the review, they will estimate the difference. If the difference is material, they will inspect the reason for the difference.

- Inspection: This is mainly done by sampling. They conduct random depreciation-related calculations, to see if they have been accounted for in a proper manner.

However, these analytical procedures cannot be solely relied on in order to help auditors get substantial evidence regarding the accuracy with which depreciation-related figures have been disclosed. Therefore, substantive testing needs to be carried out regardless.

Substantive Audit Testing

Substantive Audit Testing is carried out in order to test the audit assertions so that concrete evidence can be gathered based on which reasonable judgments can be made about the accuracy of the financial statements. The audit assertions, along with their substantive audit procedures are summarized in the table below:

| Audit Assertion | Substantive Testing |

| Existence | In order to test the audit assertion of existence, the auditors need to ensure that the assets that have been depreciated are actually carried down by the company in the previous years. They should not have been sold. These assets should be present with the organization on the date when the Balance Sheet is prepared. |

| Rights and Obligations | This requires the auditors to physically inspect the Fixed Assets to ensure that they are existent with the company, and the company has the right to use them, and subsequently depreciate them as per the accepted accounting standards. |

| Accuracy | The accuracy with which depreciation has been calculated can only be carried out using recalculation. Therefore, auditors might need to recalculate the audited figures. |

| Cut-Off | It is to be ensured that the depreciation charged is for the current year only. This can solely be done by looking at the Schedule of Fixed Assets, and comparing the changes in assets held by the company over the course of the year. |