Definition

Disclaimer is when the auditor does not give any opinion regarding a set of the financial statement. In other words, auditors distance themselves from giving any opinion on a set of financial information. The auditor may issue a disclaimer on account of the inability to obtain sufficient and appropriate audit evidence for the material balances and facts. In addition to this, the auditors conclude that undetected material misstatement may be material and pervasive.

So, auditors may issue disclaimer opinions when they cannot get satisfactory explanations and answers from the audit client about specific engagement. Further, there may be problems in accessing accounting-related records and documents. So, the auditor can decide to issue a disclaimer opinion. However, auditors disclaim opinions in rare cases. Although, it may be issued based on possible cumulative effects on the financial statement.

Explanation of the Disclaimer Opinion

The conceptual approach of auditing includes business understanding, risk assessment, the performance of audit procedures, collection of audit evidence, formation of the audit opinion, and reporting for the audit.

During risk assessment, auditors may find that some engagements carry higher inherent risk than others. Depending on the level of risk, auditors plan their procedures. For instance, if auditors assess the risk of material misstatement (RMM) is higher, they need to plan extensive audit procedures and vice versa.

During the performance of the audit procedures, they collect sufficient and appropriate audit evidence. However, sometimes the auditors may not be able to perform sufficient & appropriate audit procedures. Hence, it impacts the process of opinion formation and reporting.

For instance, auditors assess a higher risk of material misstatement in the financial statements and plan extensive audit procedures. However, during fieldwork, the management does not allow them access to the accounting records.

So, management limits the scope of audit procedures, and auditors may not obtain sufficient & appropriate audit evidence. Hence, they are left with no other option but to issue a disclaimer opinion. In other words, the auditor stated they could not cover the risk of material misstatement due to imposed limits. Hence, they withdraw from giving any opinion on the set of financial statements. Such a report is said to be a disclaimer of the audit opinion.

When Auditors Issue a Disclaimer of Opinion

In the following situations, an auditor chooses to issue a disclaimer of opinion.

- The management of the client limited their ability to perform thorough audit procedures.

- The audit client could not provide satisfactory explanations on the material facts and figures.

- Auditors may not be able to obtain sufficient & appropriate audit evidence on material facts and balances.

- Auditors were not allowed access to the company’s accounting record.

- Auditors were not able to obtain an understanding of the business transactions.

- Auditors were not allowed to observe operational procedures on the account balances.

How Disclaimer of Opinion is Different from Adverse Opinion

Disclaimer of opinion means an auditor does not give any opinion on the financial statements, and they withdraw themselves from giving any opinion on the financial statements.

It may be due to scope limitation or inability to obtain sufficient & appropriate audit evidence. On the other hand, the adverse opinion is that auditors conclude financial statements contain material misstatements. Further, such material misstatements are material and pervasive.

Such misstatements impact multiple account balances in the financial statement, and hence, their impact is material and pervasive for the users of a financial statement. Further, adverse opinion is formed when financial statements as a whole indicate non-compliance with the provision of an accounting framework.

So, the disclaimer of opinion is based on the scope limitation. On the other hand, adverse opinion is based on the observation that a financial statement contains material misstatement and greatly impacts the financial statement user.

Basis of Adverse Opinion

Following are some of the bases to form a disclaimer of opinion on the financial statement.

- The financial statement has not been prepared according to the guidelines issued by GAAP – Generally Accepted Accounting Principles.

- Multiple balances in the financial statement contain misstatements.

- The financial statement does not present a true and fair view.

- The financial statement does not remain reliable, and hence, the user should not decide based on the same.

Guidelines for forming audit opinion on financial statement

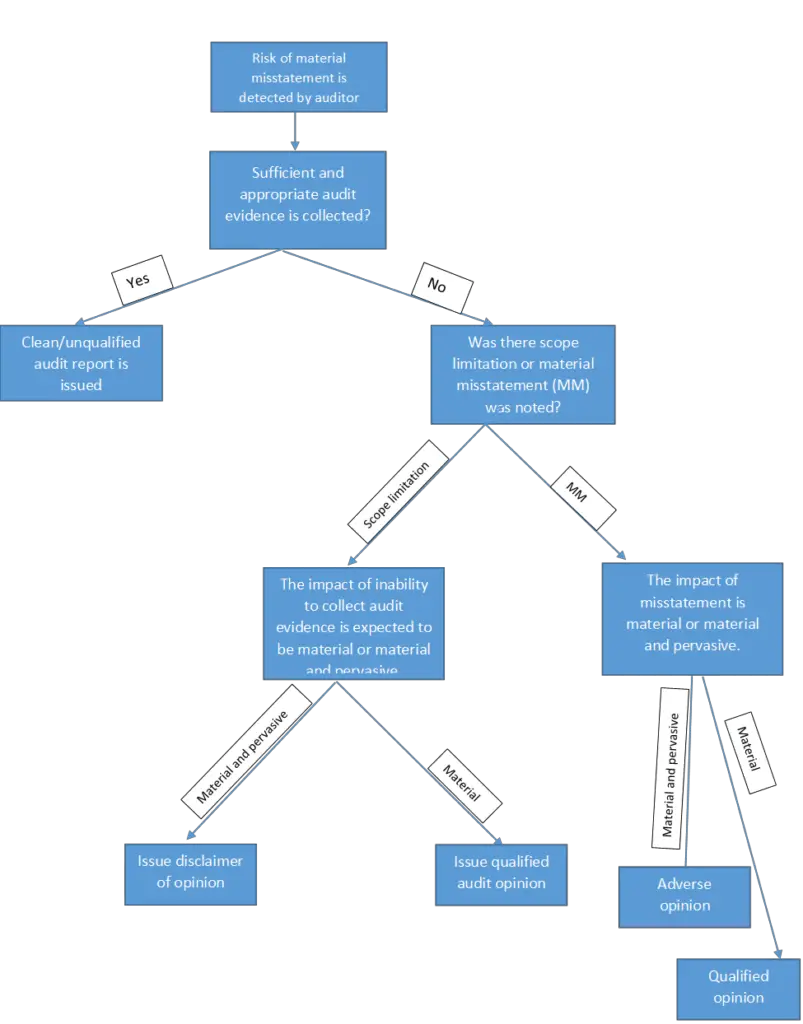

The following chart helps us to understand when auditors form different types of audit opinions.

Material and Pervasive Meaning

Misstatement is said to be material when its omission is expected to impact the decision of financial statement users. It can be about a single account balance or some disclosures. On the other hand, materially pervasive means the impact of misstatement can be seen at multiple points in the financial statement and make the financial statement as a whole unreliable.

So, if an auditor concludes that financial statements do not remain reliable, the matter is considered pervasive.

It’s important to note that adverse opinions can be harmful to the company’s reputation. It can lead to serious damage to the share price and even delisting from the stock exchange. So, the business needs to ensure compliance with the provision of the law and ensure process transparency in overall accounting processes.

Conclusion

Disclaimer of opinion is when auditors cannot obtain sufficient and appropriate audit evidence on a set of financial statements. Further, they believe underlying balances are material and pervasive that impact the overall financial statement. And the amount is said to be material when its omission impacts the decision of a financial statement user.

On the other hand, pervasive means impact of the misstatement can be seen on the overall financial statement, and multiple balances are affected by the same.

On the other hand, adverse opinion is when auditors conclude that the business’s financial statement does not present a true and fair view. Such type of opinion is formed when the financial statement contains material and pervasive misstatement.

An adverse opinion is considered a red flag for the investors and other stakeholders of the business. Further, it can adversely impact the stock and even become the cause of a delisting. So, the business must remain transparent and ensure compliance with the provisions of GAAP – Generally Accepted Accounting Principles.

Further, it’s important to note that a disclaimer of opinion is different from an adverse opinion, although both are formed when misstatement is material and pervasive. Typically, the basis of the disclaimer is that auditors cannot obtain sufficient and appropriate audit evidence. On the other hand, adverse opinion is formed when a financial statement is misstated (materially and pervasive).

Frequently asked questions

How to determine if an error/omission is material or materially pervasive?

If error/omission seems to impact a complete set of the financial statement, it’s said to be materially pervasive. On the other hand, if omission/error seems to impact some specific account balance, it’s considered material.

Based on material misstatement, audit opinion is qualified. On the other hand, based on materially pervasive misstatement, either disclaimer is issued, or an adverse opinion is given.

How is balance determined to be material in nature?

The balance is said to be material in the case of the following three cases.

- The balance is material in amount.

- The nature of the balance is sensitive – like related party transactions and some other important disclosures.

- It’s a related party balance.

What is the scope limitation in an audit?

Scope limitation refers to the inability of the business to obtain sufficient and appropriate audit evidence. It’s when auditors cannot perform planned audit procedures and obtain sufficient and appropriate audit evidence.