Auditors mainly issue disclaimers of opinion to reflect that they have been unable to gather substantial or enough audit evidence to help them to conclude the audit opinion on the engagement of the financial statements that they are auditing. This means that the auditors have refrained from presenting any negative or positive judgment regarding the company’s functioning.

The year-end financial audit of companies tends to be one of the most important courses of action for companies. This is primarily because the audit process tends to be increasingly important from the perspective of the stakeholders or the regulator. At the end of the audit, auditors tend to issue their opinion in a statement.

This opinion is based on the overall observations made during the audit process, and hence it gives much-needed insights regarding the operations of the company and its financial statements. The main objective of the auditors is to ensure that the financial statements that the company issues are not materially misstated.

Therefore, auditors carry out different audit-related processes to determine the overall reliability of the financial statements so that the stakeholders’ interests are kept intact. When issuing audit opinions, several different opinions are possible. In this regard, the following audit opinions are possible.

Types of Audit Opinion

As mentioned earlier, it can be seen that there are several different types of audit opinions that are possible. In this regard, the following opinions are issued by auditors:

- Unqualified Opinion: Also referred to as a clean audit report, unqualified opinion implies that the auditors of the company have been unable to find any concrete evidence of material misstatement in the financial statement. In other words, unqualified opinion implies that the financial statements represent a true and accurate picture of the financial position of the company.

- Qualified Opinion: This is also referred to as a qualified report. This means that after the audit of the financial statements, the auditors have been able to find substantial evidence that the financial statements have been materially misstated. Therefore, the burden is reduced from the auditors perspective, as in their audit report, they point out the inconsistencies, as well as red flags in the financial statement.

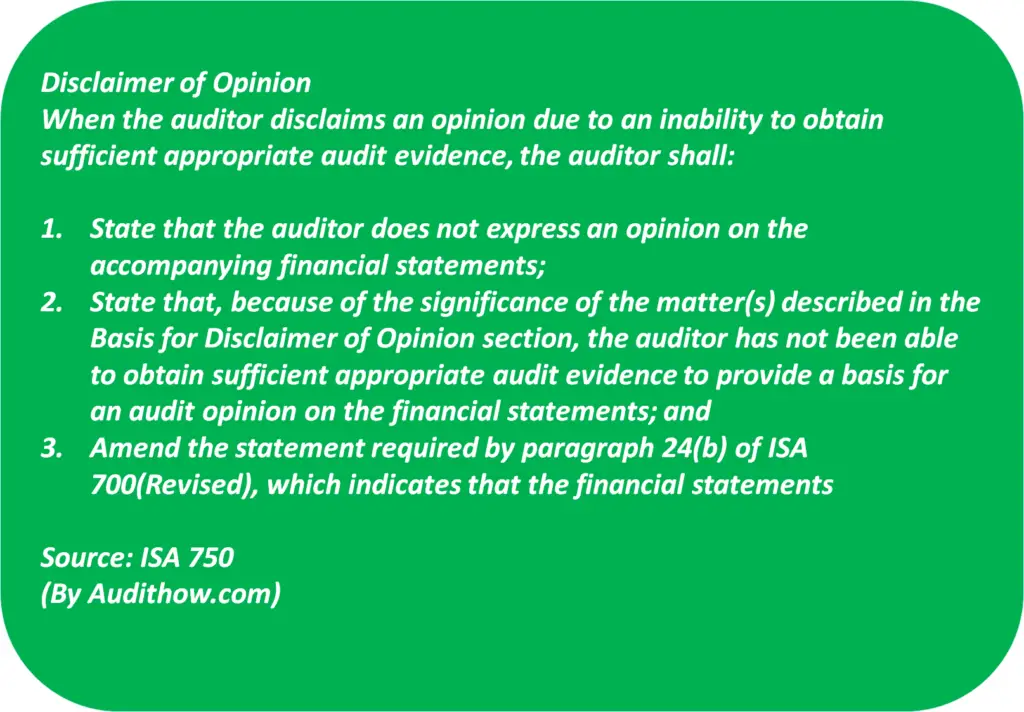

- Disclaimer of Opinion: When auditor issues a disclaimer of opinion report, it implies that the auditor has distanced themselves from providing any opinion regarding the financial statements.

- Adverse Opinion: Auditors Adverse Opinion report implies that the auditors are not fully satisfied with the financial statement. This means that the auditors have found several material misstatements in the financial statements, and hence, this is not favorable from the perspective of the auditors.

What is meant by Disclaimer of Opinion?

Disclaimer of Opinion can be described as a statement that the auditor makes that no opinion is being given regarding the financial statements of the given client. By issuing a Disclaimer of Opinion, auditors distance themselves from providing any opinion related to the financial statements.

Here is what the ISA 705, p19 said;

There can be several different reasons as to why auditors might issue a Disclaimer of Opinion. These reasons are given in the next section.

Reasons behind Disclaimer of Opinion

There can be several different reasons why a Disclaimer of Opinion is issued in the first place. The main reason behind Disclaimer of Opinion is as follows:

- Inability to gather evidence: The main objective of auditors during the audit process is to ensure that they are able to gather evidence that can help them comment on the overall accuracy and the reliability of the financial statements. Based on the evidence that is gathered, auditors then comment on the financial statements, declaring if they are free from any material misstatements or not. If during the auditing process, auditors are unable to gather evidence that proves either material misstatement, or otherwise, in that case auditors choose to issue Disclaimer of Opinion.

In this case, a Disclaimer of Opinion does not necessarily mean that the company has red flags. However, from the perspective of shareholders and investors, this might be a cause of concern because this implies that something is missing from the company’s records, which resulted in auditors being unable to present their opinion regarding their company’s financial statements.

- Lack of support by the staff: Regardless of the fact that auditors are supposed to carry out an impartial and unbiased audit of the financial statements, yet is important for the audit process to be completed using the support of the staff. This means that the accountants, as well as other staff in the company is also supposed to play a very important role in ensuring that there is complete cooperation that helps the audit to be executed in a smooth manner.

If the staff does not cooperate with the auditors, the audit process might not be executed properly. Therefore, in such a case, the auditor deems it more reasonable to distance from the audit process, thereby issuing a Disclaimer of Opinion.

- Inconsistencies in Financial Data: In certain cases, despite the organization being a going-concern, and a profit-bearing entity, there are certain inconsistencies in the financial data. If auditors are unable to comprehend data, and decide if this was because of fraudulent activities, or improper accounting records, they prefer to issue a Disclaimer of Opinion.

They issue a Disclaimer of Opinion and not a qualified report since there was no reasonable evidence to conclude that there were intentional misstatements in the company’s financial statements.

Implications for Disclaimer of Opinion

From the perspective of organizations, it can be seen that auditors opinion, and report holds tantamount value. This is because it tends to be the most sought-after document for investors since they get clarity regarding the company’s operations.

In this regard, it is important to ensure that the audit report communicates the actual and fair view of the company, which can help them make decisions in a fairly accurate manner. In the case where auditors issue Disclaimer of Opinion, the following implications might arise for the company:

- The investors might not be confident in investing in the company. Regardless of the fact that it is not a qualified or an adverse audit report, yet it still raises grounds of suspicion that might eventually lead investors to withdraw their investments from the company.

- Disclaimer of Opinion might not only worry the investors, but it might also have negative repercussions for the creditors of the company. They might think that there is something wrong with the company, and hence, this might result in creditors losing confidence.

- The overall loss of repute as a result of Disclaimer of Opinion is something that might stay with the company for a considerable time frame, and hence, this might have catastrophic impacts for the company in the long term.

- It might result in a drop in credit rating for the company, since it would no longer be classified as a safe and secure investment.

What should the company do if it gets Disclaimer of Opinion?

The main course of action adopted by companies when it comes to Disclaimer of Opinion is to do some damage control. This involves ensuring that the company prepares a new set of financial reports or comes up with a strategy that solves the reservations of the auditors. This is the only course of action that the company has, and they should try to get a clean audit report as soon as possible.

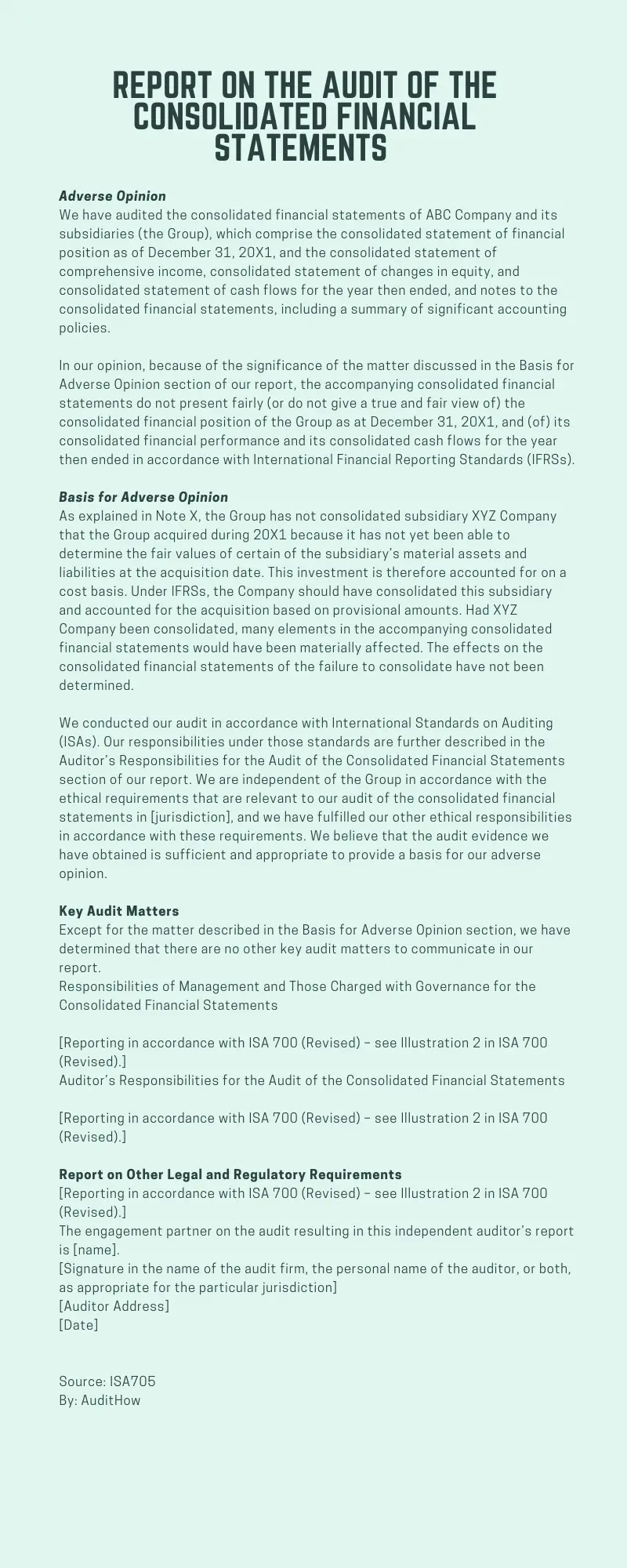

Sample of Adverse Opinion base on ISA 705