An assurance engagement is a type of project carried out by accounting professionals. It will usually end with a report being issued. The report contains the professionals’ opinions on a subject matter based on a certain set of criteria.

This opinion enables the users to read the report with confidence and base their own decisions upon it.

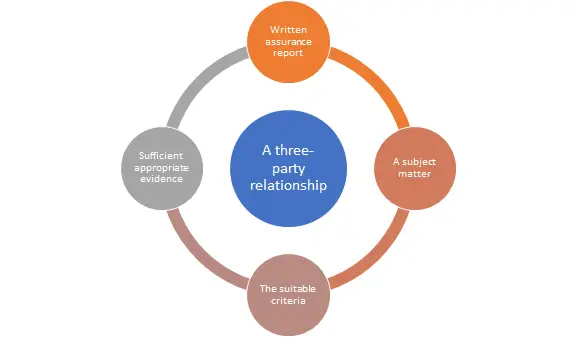

An assurance engagement consists of five elements, which we are going to explain in detail below.

The 5 Elements of Assurance Engagement

The five elements of an assurance engagement determine the parties involved and dictate the scope of the engagement. These five elements must be established by all parties involved before the start of an assurance engagement. These elements are as follows:

1) A three-party relationship

In an assurance engagement, usually, three parties will be involved. This is the first element to be considered in any assurance engagement.

These three parties normally include the intended users, the party responsible for the subject matter that the practitioner will examine, and lastly, the practitioner.

The intended users are basically the users of assurance reports. They will normally receive services, information, or assets of the responsible party of the subject matter.

That means they are the stakeholders who will be receiving the report and use them to make decisions. They include both the business owners, the board of directors, the shareholders, the investors, the authorities, etc.

Those responsible for the subject matter that is going to be examined by the practitioner are usually the client’s management. It is usually the management because they are in charge of running the business operations, providing information to users, and preparing the financial statements. The management also has the responsibility to provide help to the practitioner throughout the engagement whenever needed.

Another party is the practitioner. They are accounting professionals from an external firm who will either audit the entity’s financial statements or provide other limited assurance services. For example, if it is an audit engagement, it will be the auditors.

The practitioner will use their professional judgment to review the financial statements prepared by the management. At the end of the engagement, the auditor will issue whether the financial statements are true and fair.

Both users and the responsible party may engage the practitioner. They can either engage the practitioner individually or together. The practitioner will have to ensure that they are independent at all times during the assurance engagement.

2) A subject matter

The subject matter is essential to an assurance engagement. A good subject matter needs to fulfill certain criteria to be a part of an assurance engagement.

It needs to be clear, well-defined, and can be consistently assessed or measured. Not just that, there should be appropriate evidence to support the information provided in the subject matter.

This is because a subject matter is a piece of material given by the responsible party, and the practitioner will base their opinion on this piece of material. Without a clear and assessable subject matter, the practitioner will not be able to issue an opinion.

Subject matter will be different for different types of assurance engagements and is normally the financial statements prepared by the entity’s own management.

3) The suitable criteria

Every assurance engagement should have its own set of criteria. Without the suitable criteria, the practitioners will not be able to review the given subject matter. So what are they?

This depends on the assurance engagement. If it is an audit engagement, the criteria will be the accounting standards that the management uses to prepare the financial statements.

For example, management uses the International Financial Reporting Standards (IFRS) to prepare financial statements. During the audit, the auditor will review management’s work by verifying it against the IFRS’s accounting rules to ensure the client has prepared the financial statements according to IFRS.

Again, the suitable criteria change for different engagements. They largely depend on the engagement nature, where the entity resides, the jurisdiction, and its own internal policies.

4) Sufficient appropriate evidence

To issue an opinion on the subject matter, the practitioners will need to collect evidence. The evidence collected must be sufficient and appropriate based on the International Standards of Auditing.

The evidence gathered will affect the final opinion issued and determine if the financial statements are true and fair. Without such evidence, the practitioners can’t prove the information supplied by the management in a given subject matter.

The sufficiency of the evidence is determined based on its quantity, while its quality determines appropriateness. The practitioner can only assess if the provided information is accurate and complete by having the evidence. The management is fully responsible for providing such evidence to the practitioner.

5) Written assurance report

Finally, after the practitioner has all done all his work verifying the subject matter against the suitable criteria and collecting sufficient and appropriate evidence, a written assurance report will be issued. This is where the practitioner presents the result of their work to the users in the form of an opinion.

To ensure the report can be relied upon, the auditor must be independent of the client’s management or the entity itself. Any threat to independence or conflict of interest needs to be handled with proper safeguards not to cause the quality of the opinion to be impaired.

Generally, in the report, the practitioners will state that they are providing reasonable or limited assurance. The users can then make relevant decisions based on the report. This issuance of a final report signals that the assurance engagement has come to an end.

Summary

In conclusion, assurance engagement is a project where the users engage a practitioner to issue an opinion about a subject matter prepared by the management. During the engagement, the practitioner reviews the subject matter and checks it against suitable criteria. These are the five elements of assurance engagement.