Definition

The process of audit is considered to be one of the most cumbersome processes and tasks over the course of time. In this regard, it is important to consider the fact that there are numerous risks that are involved during the audit process. They are referred to as audit risks.

Audit risks can be defined as the risk that the auditor expresses as an appropriate audit opinion when the financial statements are not representative of the actual financial condition of the company. In other words, it implies that the financial statements are materially misstated. Audit risk is defined as a function of the risks of material misstatement and well as detection risk. Therefore, audit risk is known to have two broad components, which include risk of material misstatement and risk of detection.

As far as Risk of Material Misstatement is concerned, it can be seen that this is the risk that the financial reports contain several material misstatements before the audit process is undertaken. The threshold of materiality in this regard varies from organization to organization. The auditors, as well as the accountants in the company are well aware of the materiality threshold. Therefore, this risk is often higher in the cases where the company does not have sufficient internal controls present. However, it can really pave way for an even more damaging fraud risk, and therefore, this particular risk needs to be mitigated by companies at all costs.

Secondly, as far as Detection Risk is concerned, it is the inability of the audit procedures to detect a material misstatement in the accounts of the organization. This risk is also very detrimental from the long term perspective of both, the auditor, as well as the organization. Therefore, an active effort should be made in order to reduce this particular risk.

Audit Risks Model

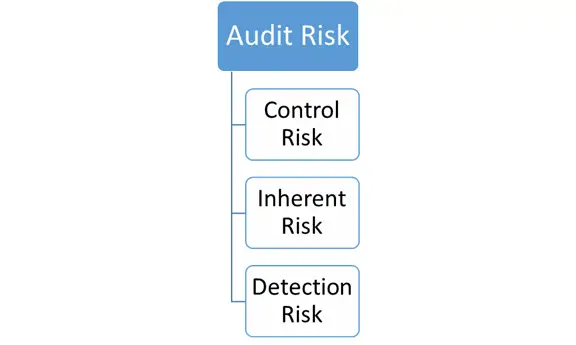

Audit Risk Model is a tool that is used by the auditors in order to understand the relationship between various risks that exist during the normal course of the audit process. This particular model suggests that the total risk that exists over the course of the audit is a factor of three risks, inherent risk, control risk, as well as detection risk.

The auditors’ goal when conducting audit is to reduce the audit risk to an acceptable level. Therefore, in order to do that, there is a need to assess all the relevant components within the risk model to understand which particular denomination can be compromised upon.

Regardless of the fact that in most cases, these risk values are not easily quantifiable, auditors are supposed to use their professional judgement in order to assess the underlying risk involved. Therefore, under the audit risk model, the answer is not always in numerical terms. There are often other descriptive statistics that are used in order to ascertain the level of risk involved.

After the auditors are able to gauge the relationship between the different components, as well as the total risk resulting as a consequence, they then aim to reduce the risk to an acceptable level. In this regard, it can be seen that the risk of material misstatement is declared to be under the control of the management.

Hence, an auditor might not have total control regarding leveraging that particular risk. However, they can directly tweak the detection rate in order to offset it. For example, if during an audit process, the auditors realize that the risk of material misstatement is high, they need to reduce the detection risk in order to ensure that the total audit risk is under an acceptable level.

Formula

As mentioned earlier, Audit Risk is a factor of three types of risks, which include inherent risk, control as well as detection risk. This is summarized in the following table:

Audit Risk models involves quantifying audit risk in the form of an equation, which is represented in the form of the following equation:

Audit Risk = Inherent Risk x Control Risk x Detection Risk

The reason as to why these risks are multiplied and not added is simply because of the reason that in the case where one of these risks exists, it tends to have an exponential impact on the overall audit risk. If one risk exists, it tends to amplify the overall audit risk by a factor of more than 1. Therefore, these risks are multiplied in order to get the underlying audit risk.

Types of Audit Risk

There are three main types of audit risks that are involved during a typical audit process. They include the following:

- Control Risks

- Detection Risks

- Inherent Risks

Subsequent explanation regarding the types of these audit risks is given below.

Control Risks

Control Risks are the risks that exist within the company because of the lack of internal controls present within the company. Alternatively, control risks might also exist in cases where the internal control system of the company fails to point out any material misstatements within the financial statements.

The internal control structure of the company safeguards them against potential losses. Therefore, internal controls must not only be present within the company, they should also be effectively minimized in order to ensure that the company has protection against fraudulent activities. In the case where an organization does not have sufficient internal controls present, it substantially increases the work of the auditors.

This is primarily because of the fact that the auditors need to identify procedures that ensure that all the relevant ground pertaining to internal controls within the company is properly covered.

Detection Risks

Detection Risk is risk of auditors being unable to detect material misstatements in the financial statements of the company. This risk mainly occurs in the case where auditors’ methods or procedures is insufficient to detect the existing shortcomings of the financial statements. In other words, detection risks mainly occur because of the inefficacy of the stated financial statements.

The detection risks are also increased when the audit team member who assigned to conduct the audit of the company’s financial statements are not competence both in term of audit knowledge and experiences as well as industry knowledge.

For example, the firm just won the new big construction company and most of the audit team member including manager and partner are new to the construction company. In this case, the detection risks are high and the change that auditor find mistrial misstatements are really low.

Inherent Risks

Inherent Risks are perhaps the most naturalistic risk that often occurs during an auditing process. The main reasons behind inherent risks lie as a result of the nature of the transaction involved. At certain times, auditors need to tackle these risks by using their professional judgment, as well as their analytical insights to reduce the inherent risk of material misstatement.

How to reduce Audit Risks?

After a subsequent understanding and evaluation of the audit risks, it is the responsibility of both, the management as well as the auditor to reduce these risks. However, the major chunk of the responsibility is on the part of the auditor, since he is responsible for gathering evidence and presenting an opinion on the financial statements. Therefore, it is fundamentally important for an auditor to reduce these audit risks to an acceptable level. This involves inculcating the following steps:

- Audit Procedures designed to specifically address the risk of material misstatement: When carrying out audit procedures relevant to testing assertions, there needs to be a special focus on not only identification but also on mitigation of these particular audit risks. This includes devising procedures that can check for these risks, as substantive procedures intended towards reducing the audit risks.

- Evaluation of the Appropriateness of the Audit Evidence: Evaluating the appropriateness of the audit evidence is also an integral cog in risk mitigation. It is important to gauge whether the existing audit evidence is sufficient. In the case where existing audit evidence cannot be solely relied on to extrapolate the audit outcome, it is better to gather more evidence so that the risk is minimized.

- Fostering relationships with the client: Since Audit engagement contracts are signed for a couple of years, it is important for the auditor and the organization to work hand in hand in order to reduce the level of risks involved. It plays out in the favor of both parties. Hence, the auditor should ensure that internal controls are properly implemented in the organization so that overall risk can be controlled.