Overview:

Cost of Goods Sold is considered to be one of the most important cost components when it comes to financial statements. This is because this is perhaps the most impactful line item that greatly influences the overall profitability of the company. Additionally, it can also be seen that cost of goods sold, in itself, includes various different outcomes that are added or subtracted in order to arrive at the total figure for the cost of goods sold.

Therefore, the cost of goods sold needs to be properly audited in order to ensure that the financial statements are not materially misstated. The assertions, as well as the processes designed in order to audit the cost of goods sold, tend to be a very important course of action for companies, primarily because of the high level of risk involved when it comes to auditing the cost of goods sold.

What does Cost of Goods sold comprise of?

Cost of Goods Sold is the cost that is incurred in order to bring the goods to a sellable state. In this regard, it is important to consider the fact that the cost of goods sold mainly constitutes the relevant costs for the particular year so that they are matched with the respective revenues for the particular year. Therefore, it is important to understand the formulation of the cost of goods sold, so that the relevant audit risks and procedures are accounted for in this regard.

Cost of Goods Sold is computed using the following formula:

Cost of Goods Sold = Opening Inventory + Purchases – Closing Inventory

Therefore, all these 3 different line items need to be compared and computed in order to arrive at the figure for the cost of goods sold. Hence, auditing the cost of inventory includes an audit of inventory, as well as an audit for purchases.

Risks Associated with Auditing Cost of Goods Sold

Given the fact that the cost of goods sold is a significant line item, it comprises a fairly stringent process to test for accuracy. There is an inherent risk associated with the cost of goods sold that should be included. Other relevant risks include control risk, as well as material misstatement risk. These risks are further explained in detail below:

- Inherent Risk: There is an inherent risk of misstatement in the cost of goods sold, predominantly because of reason that it involves inventory. Because of this particular reason, it is important for auditors to ensure that these particular risks are accounted for, in order to facilitate higher accuracy and proper representation. Furthermore, the inherent risk in this regard is primarily on the ground of inventory being miscalculated, or be non-existent on the financial statements.

- Control Risk: Internal Control tends to be a highly important task and objective when it comes to inventory management. In this regard, it is imperative to note the fact that in the case where there are internal controls present, the overall risk of inventory miscalculation is somewhat minimized. On the other hand, the overall risk profile is considerably high in cases where there are no internal controls present within the organization.

- Risk of Material Misstatements: Just like revenue audits, purchase audits also hold tantamount value from the perspective of proper audit is taking place. In this regard, it is important for auditors to realize the fact that there is a risk associated with purchases, and audit procedures need to be designed in order to ensure that purchases, along with inventory figures are reconciled so that the declared cost of goods sold can be validated.

Audit Assertions

Since Cost of Goods Sold audit is an important component of the audit process, it can be seen that the audit assertions for cost goods of sold are considerably significant in this regard. The following audit assertions are accounted for when planning for the audit:

- Accuracy: The assertion of accuracy implies that all the transactions should be accurately recorded in the financial statements. Alternatively, this implies that all year-end balances for all the respective components of Cost of Goods Sold should be accurate. In the same manner, they should be valued and categorized as per accounting principles.

- Completeness: All year-end inventory, as well as relevant purchases for the year, should be mentioned in full in the financial statements. It is important to recognize the fact that they should be mentioned incomplete and full nature so that the right picture can be depicted to the users of the financial statements.

- Cut-Off: This particular assertion emphasizes the fact that only those balances should be included in the balance sheet that is relevant to the current year. Any balances prior to the current reporting financial year or balances in the following year should not be incorporated in this regard.

- Rights and Obligation: This assertion implies that all the declarations on the financial statements should be backed with resources that are actually held by the company at the given point in time.

Audit Procedures in Auditing Cost of Goods Sold

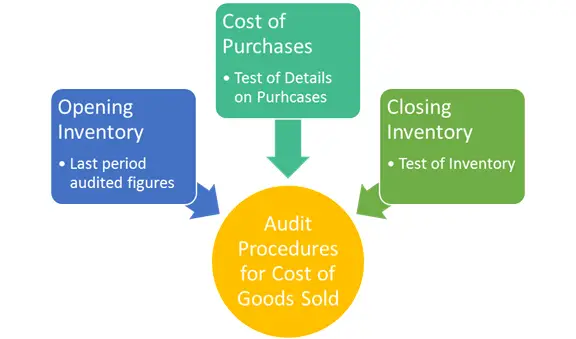

Audit Procedures for Cost of Goods Sold comprise of testing around all the components involved in the cost of goods sold formula. All the different components are tested differently, as shown in the picture below:

In order to test for the assertions mentioned above, Substantive Audit Procedures are designed in order to get an accurate depiction.

This implies that the following assertions will be used in order to gather the required evidence. These substantive procedures are summarized in the table below:

| Substantive Audit Procedure | Description |

| Cut-off Analysis | This particular process is designed in order to ensure that proper details are included in the financial statements that are relevant to that particular year only. This is to ensure that there is no misstatement about the ending inventory because overstated ending inventory can significantly reduce the cost of goods sold, thereby inflating gross income. |

| Observing Physical Inventory Count | Observing physical inventory count is also an important audit procedure in order to ensure that the audit assertion of existence, as well as rights and obligation, is duly tested out. By verifying the physical inventory count, auditors can ensure that proper accounting standards are duly maintained. |

| Inventory Reconciliation | Inventory reconciliation via the general ledger is a substantive test of detail in order to ascertain if there are any inconsistencies in the inventory flow. It is considered to be an important step that helps to reconcile the purchases, with sales, as well as inventory. |

| Testing high-value items | Testing high-value items tend to be an important component. Since all inventory items cannot be potentially physically verified, auditors often pick and choose items that are high risk or high value. |

| Testing for valuation | Inventory valuation tends to be another important component in ensuring that proper costs have been accounted for. In this regard, it is important for auditors to ensure that the valuation that has been declared by the company is accurate, and in accordance with the market principles. This means that inventory should be recorded at a lower cost or net realizable value. |

| Testing for item costs | Purchase reconciliation also tends to be increasingly important in terms of verifying that all correct purchase items are included in the stated analysis. |

Therefore, it can be seen that all the respective components of the cost of goods sold are tested separately using substantive audit procedures. After the subsequent analysis, the figures in the cost of goods formula are added in order to arrive at the audited value for the cost of goods sold.