Overview:

Audit tends to be a process spread across numerous different aspects that need to be inculcated by the auditors to ensure that they can gain the required evidence.

This involves testing various assertions on several different grounds to get reasonable assurance on several grounds.

In this regard, audit planning tends to play a very important role, primarily because it helps auditors prioritize which part of the audit they should carry out first, and which should be conducted at a later stage.

Auditing for revenue holds substantial value when it comes to auditing revenue, predominantly because it tends to be the most crucial part that impacts the company’s overall financials.

Therefore, auditing revenue from the company’s perspective holds tantamount value, because it needs to be tested across various assertions.

Risks in Auditing Revenues:

Revenue audit is often considered to be a high-risk process in the company because the inherent risk is mostly high when it comes to revenue. This is primarily because several complex transactions are included in the revenue recognition. Therefore, the main aim of the auditor is to reduce the risk associated with a material misstatement resulting from material misstatement in the financial statements.

The risk of Material Misstatement is defined as the risk that the line items mentioned in the financial statement have a higher variation than their actual figures.

In this regard, it is important to consider that the risk existing in revenue audit pertains to the revenue figure being materially misstated to an extent that internal controls cannot detect that particular risk.

Further explanation of the risks associated with Revenue Audit is provided below:

Inherent Risk

The inherent risk in the revenue audit process pertains to the exposure of revenue figures to misstatement. In this case, the level of inherent risk is also contingent on the nature of the business and the complexity of the transaction involved.

An example of inherent risk in revenue would be recording scrap materials sold as general revenue of the company.

Control Risk

As far as the Control Risk of revenue is concerned, it mainly results from the failure of the internal controls to detect the inherent risk. In this regard, revenue might be in a position to misstate the company’s financial position severely.

Therefore, control risk tends to play a very important role in revenue.

Therefore, the main role of the auditor when it comes to auditing revenue is to ensure that the assessment is undertaken to plan the subsequent part of the audit process in a clear manner.

Followed by the assessment, they are supposed to draw audit procedures based on the assertions they need to test for when it comes to revenue.

Assertions:

The audit assertions that are used when testing for revenue are as follows:

- Occurrence: This assertion mainly tests if the revenue declared by the company exists on the financial statement or not. This is a verification that the sale process has occurred.

- Completeness: All revenues declared on the financial statement should be complete in terms of their classification. For example, they should be mentioned in full as any disclaimers that follow the relevant sale.

- Accuracy: Revenues declared on the financial statements should be accurately measured. There should be no material misstatement in rounding off or any other relevant errors that might tweak the end of the financial statements for the end user.

- Cut-off: The revenues declared for the particular year, should belong to that specific time frame only. Therefore, revenues for any previous year or the following year should not be included in the current year’s revenue.

- Classification: Revenue should be classified properly, and it is only supposed to include amounts that are earned (or received) as a result of the business’s day-to-day operations. Any sale of fixed assets or any other financial incoming should not be classified as revenue for the company. Similarly, the organization is also supposed to draw a line between earned, and unearned revenue.

- Presentation: The revenue presentation should abide by the accounting norms and principles. Sufficient and complete disclosure should be made with revenue, to state any disclaimers that users of the financial statements should be aware of.

Procedures:

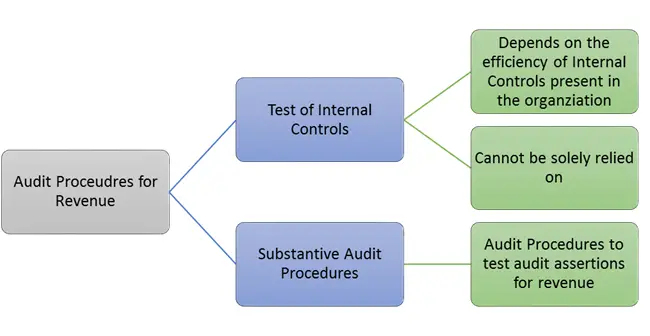

Audit Procedures for testing revenue include both, Tests of Controls, as well as Substantive Tests.

Both of them are given in detail below:

Test of Controls:

In the case of auditing revenue, Internal Controls play a very important role. This implies that in the case where internal controls are effectively present, it is assumed that the control risk is low.

In other words, it means that the internal controls effectively prevent, detect, or correct material misstatements that occur in the revenue account.

Therefore, the audit procedures involve testing these controls to obtain sufficient audit evidence to support the given assessment. However, these tests are only performed when the auditor wants to rely on internal controls to reduce the inherent risk of material misstatement.

If the auditor does not want to rely on internal controls, then audit procedures rely solely on substantive tests. In this regard, the test of controls includes the following:

- Inquiring the client’s staff concerning the internal controls processes

- Observing the actual implementation of the internal control processes

- Inspection of the supporting documents to ensure that proper controls have been established

- Re-performing the controls that the client’s staff has performed

Furthermore, a few other details need to be included in auditing revenue. They include the following:

- Authorization: It needs to be seen if there is an authorization process for sales confirmation or order dispatches.

- Segregation of Duties: The presence of segregation of duties is imperative to ensure that no conflict of interest might give room for any fraud.

- Completeness of Revenue: Completeness of Revenue is obtained by verifying the sequencing presented in the financial statements.

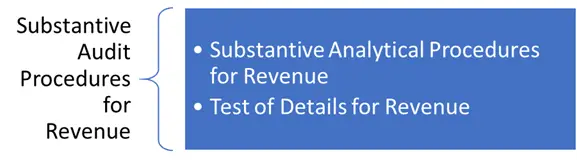

Substantive Audit Procedures for Revenue

Substantive Audit Procedures for Revenue include the following components:

Further details of these are given below:

1) Substantive Analytical Procedures

Substantive Analytical Procedures for Revenue mainly include inspection and observation by the auditors to inspect the changes in trends that have occurred in the previous years.

For example, there is a need to ensure no inconsistencies in the sales figures over time.

The actual occurrence of revenue should ideally be aligned with the actual figures. If this does not happen, it is important to follow this up with relevant tests for details.

However, even if proper concrete evidence is obtained from substantive analytical procedures, the test of details is still required.

2) Test of Details for Revenue:

In order to test details for revenue, audit procedures are designed around assertions. Examples and descriptions of the test details are given in the table below:

| Audit Assertion | Example of Audit Procedure |

| Occurrence | Selecting a sample to check for records of sales revenue, followed by vouching, and tracing those sales invoices with respective sales entries. |

| Completeness | Selecting a sample of bills, tracing these selected bills, and scanning the sequential number of sales invoices in the sales journal. |

| Accuracy | Selecting a sample of sale invoices, and further verification of sales invoices with supporting documents in order to make sure that they are properly recorded in the financial statements. |

| Cut-Off | Selecting a sample of invoices (at random) from the year-end, and checking if they have been correctly classified. |