Overview:

Year-end audits are considered to be one of the most important elements that highly impact the organization because they directly tend to impact the decision-making ability of the users of the financial statements. Therefore, in this regard, it is highly important to consider the fact that it is highly important to make sure that operating expenses tend to be one of the very important line items in the company’s income statement.

Operating Expenses, by their very nature, are considerably larger and relatively complex in nature. Consequently, I can it can be seen that they significantly impact the underlying profitability of the company. Since some multiple different heads and accounts are included as operating expenses, it can be seen that there is a need to properly audit expenses in order to make sure that there has been no material misstatement that might tweak the profitability of the company.

Risks Associated with Operating Expenses

Two main risks need to be accounted for by auditors when it comes to auditing operating expenses. These risks are referred to as Detection Risks and Risks of Material Misstatement. Subsequent explanation of both these types of risks is as follows:

- Detection Risk: Detection Risk refers to the inability of the auditors to point out any inconsistencies in the declaration of the operating expenses. Since operating expenses constitute a significantly larger portion of expenses, the detection risk is relatively high. Within these categories, there are several different elements that have an inherent risk.

- Risk of Material Misstatement: The risk of material misstatement refers to the inability of the audit process to point out any material misstatement in the financial statement. Operating Expenses might also include expenses that necessarily don’t have a proof trail. This considerably results in a higher risk of material misstatement that needs to be incorporated by the auditors when auditing the financial statement.

How do auditors reduce the risk associated with auditing of operating expenses?

In addition to being aware of the risks involved when auditing operating expenses, auditors also need to be sure to minimize their risk to a maximum level. Given that there is an inherent risk involved that cannot be eliminated, auditors need to devise a strategy that ensures that both detection and material misstatement risks are minimized to the utmost extent.

This might include the auditors conducting interviews, observations, and analysis before the actual audit part. They can design their subsequent audit procedures to get reasonable assurance.

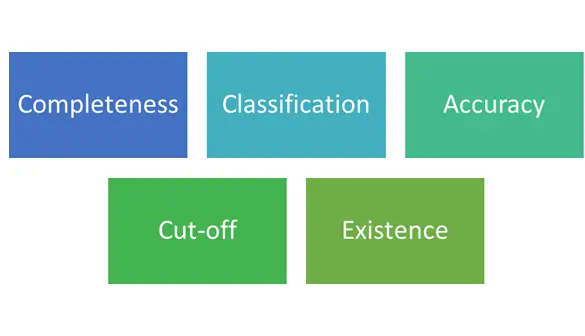

Audit Assertions with Operating Expenses

When conducting an audit for operating expenses, certain assertions need to be borne in mind to ensure that the best possible results are obtained. These audit assertions are given as below:

- Completeness: All expenses should be included in their complete nature. This implies that organizations should be able to include all expenses completely. They should not be omitted, regardless of the viability of expenses.

- Classification: All expenses should be correctly classified in their correct categories. Categorization of fixed expenses as operating expenses is a common example of a mistake or an error that a lot of organizations go through.

- Accuracy: Operating expenses constitute several different cost-related components. Consequently, it can be seen that they are supposed to be accurately included in the ledgers so that no important piece of information is missed out upon.

- Cut-off: Only those expenses should be included in the financial statements that are relevant to the current financial year. In this regard, it is important to note the fact that the matching principle should be duly applied in the preparation of the financial statements. Revenues for a particular year should be matched with the costs with the particular year.

- Existence: Only those expenses should be included in the financial statement that exists in terms of proof. Organizations cannot declare expenses that are not properly existent on the financial statement, and this tends to be a very important dynamic in this regard.

Audit Procedures during Auditing Operating Expenses

In order to test for operating procedures, auditors need to ensure that they are able to design and plan the audit process properly. This includes both analytical procedures as well as tests of details.

Analytical Procedures for Auditing Operating Expenses

As far as analytical procedures are concerned, it can be seen that they mainly involve inspecting and observing the functions within the organization in order to get an idea regarding how the substantive testing is likely to be carried out.

In this regard, auditors need to ensure that they are able to observe the level of internal control within the organization. This implies that auditors need to ensure that there are sufficient internal controls that can prevent any kind of fraud or cash embezzlement under this particular head.

Hence, it can be stated that the analytical procedures surrounding the audit process primarily lie in the realms of proper observation of the stated operations to ensure that there are no red flags within the stated affairs of recording the recording and subsequent disclosure of operating expenses.

Substantive Testing for Auditing Operating Expenses

In addition to carrying out analytical procedures, there is a need to carry out substantive testing regardless of the efficacy of the analytical procedures. This is important because it specifically tests the operating expenses at a transaction level. This, in return, marginally helps organizations to auditors to gain sufficient evidence that can help them gain reasonable assurance regarding the presentation and disclosure of operating expenses. In this regard, the substantive tests that are carried out are summarized in the table below:

| Audit Assertion | Substantive Testing |

| Occurrence | In order to test the assertion of occurrence, the following substantive tests are carried out: Reasonability of the expenses incurred – in order to check if they are consistent with the industry trends and general logic. Double-checking occurrence by verifying the journal entries via sampling to ensure that the transactions recorded as expenses have actually occurred in the financial statements. Physical verification of employee pay-slips in order to ensure that the salaries declared have been true in terms of the declared amounts. |

| Completeness | In order to check for the completeness of the operating expenses that have been disclosed, the following substantive tests are carried out: Payroll analysis to check for the gross and net amounts that have been paid to the employees. Depending on internal controls and authorization channels within the organization, there is a need to check if all operating expenses are complete in nature. |

| Classification | The main premise of this audit assertion is to ensure that operating expenses have not been overlapped with amounts paid in order to settle accounts for current assets or fixed assets. This is checked by verifying all the expense accounts to ensure that they have been properly categorized. |

| Cut-Off | Only those expenses should be disclosed on the financial statements that are relevant to the current financial year. This is also verified by means of checking payment dates. Payment of a certain expense should not necessarily be considered as an expense for a particular year. |

| Accuracy | This particular audit assertion is tested using random checking of expense journals to determine if they have been totaled correctly and if there is any calculation error in the declaration of these expenses in the financial statements. |