Overview

Auditing tends to be a significantly important task from the perspective of the organization, as well as from the perspective of the external stakeholders. In this regard, it is important for stakeholders to realize the fact that there are multiple different elements that need to be included during the auditing process, in order to ensure that all the required evidence is gathered based on which substantial evidence can be put forth by the auditors.

In this regard, interest income is one particular element in the financial statements that need to be properly audited. Interest income constitutes other income that is generated by the company. Calculation of interest income is often matched with the amount that is received in the bank relevant to the interest income.

However, this might not always be the correct approach because interest income relevant for the current accounting year might not be paid in the very same year. Therefore, it is important to ensure that interest income is audited properly so that it is ensured that it is not materially misstated.

Risks associated with auditing Interest Income

Interest Income may, or may not exist on the financial statements of the company. In the case where companies do have interest income on their financial statement, auditors need to factor in the risk associated with the declared interest income.

Additionally, they also need to devise strategies to ensure that they are able to mitigate this particular risk to a minimized level.

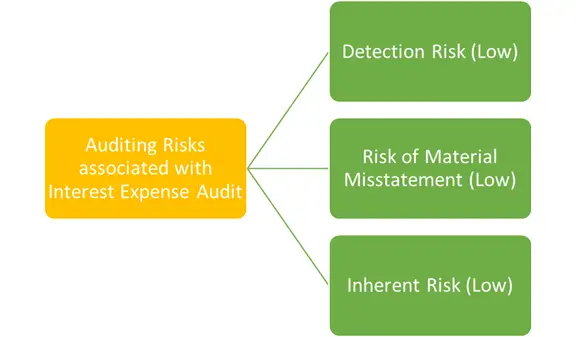

Therefore, the existing levels of risks associated with interest income are as follows:

- Detection Risk: Detection Risk implies that the interest income would be misstated, and the auditing procedures that would be designed in this regard would be insufficient to detect this. Generally, in the case of interest income, detection risk is low because there are several controls present that make it relatively impossible for organizations to tweak with this particular amount. However, it stands to be a risk nevertheless and needs to be accounted for by auditors when deciding on the audit procedures.

- Risk of Material Misstatement: The risk of material misstatement pertaining to interest income relates to the fact that the organization reported and disclosed the amount for interest income in an incorrect manner. This implies that the amount of interest income mentioned on the financial statements is materially different from the amount actually earned by the organization in the form of interest income. Regardless of the fact that this risk is also lower in threshold as compared to other items on the financial statement, yet auditors need to ensure that they are able to devise procedures in order to minimize the overall risk involved.

How can auditors minimize the risks involved in auditing interest income?

By the very nature of the interest income, it can be seen that the overall inherent risk is relatively low. However, auditors need to incorporate certain procedures in order to gather substantial evidence that can ensure that the amount for interest income has not been materially misstated. This mainly includes verification and reconciliation via the ledgers, as well as the account statements where interest has been deposited.

Audit Assertions Associated with Auditing Interest Income

When Auditing for Interest Income, there are certain audit assertions that need to be included in order to ensure that proper ground has been covered based on which auditors can give reasonable assurance regarding the accuracy and reliability of the interest income (and subsequently, the reliability of the financial statements). Therefore, the following assertions come into play when auditors audit interest income:

- Existence: The audit assertion of existence implies that all the interest income that is mentioned as revenue by the company should exist in terms of an investment by the company. In this regard, it is also important to consider the fact that they exist in reality, rather than just being disclosed in the financial statements.

- Cut-off: The interest income that has been generated for the particular year should be relevant to that particular year only. Regardless of whether the income has been credited, to the account or not, only that interest income should be mentioned on the financial statements that are relevant to the current year.

- Accuracy: The calculation of interest income can often be confusing if interest-bearing components are rendered during the middle of the year. In this regard, this audit assertion involves ensuring that the audited income that has been disclosed on the financial statements has been accurately calculated and subsequently disclosed in the financial statements.

- Completeness: The audit assertion of completeness involves validating that the interest income that has been disclosed by the auditors is complete in nature and includes all the relevant information. This also overlaps with the audit assertion of classification that states that interest income should be classified as other income, and should not be mixed with the main revenue of the business.

Audit Procedures used to Audit Interest Income

In order to test the audit assertions that are mentioned above, it can be seen that auditors need to design procedures that can help them gather evidence based on which they can attain reasonable assurance. The audit procedures are mainly divided into two broader categories, which constitute analytical procedures as well as substantive testing. Subsequent descriptions of both these audit procedures are given below:

Analytical Procedures

When it comes to interest income, the first and the foremost step is to ensure that auditors are able to get an idea regarding the chance of audit assertions already being engraved in the internal control process of the company. This requires them to check for analytical procedures, based on which they are able to devise a strategy pertaining to the substantive testing that follows.

The main analytical procedures that are followed in this regard are observation, and a check of internal controls that can help the company to ensure that they are able to meet the required objectives.

Substantive Testing

The major chunk of audit procedures mainly lies in the realms of substantive testing. This requires auditors to check the interest income in the form of individual transactions in order to ensure that all the audit assertions have been duly met. The list of audit assertions, and their relevant substantive testing is summarized in the table below:

| Audit Assertion | Substantive Testing |

| Existence | In order to test this particular audit assertion, there is a need to verify that that the interest income that has been declared on the financial statements is in line with the investments that the company has made. This is reconciled by checking investment schedules, as well as tests for details. |

| Cut-off | Cut-off analysis is conducted in order to ensure that all the interest income that is declared on the financial statement pertains to the specific year only. This covers ground pertaining to interest income for the year, and the interest income received (or credited in the bank account) in the subsequent year. |

| Accuracy | Interest Income that is declared on the financial statements should be accurately represented in terms of calculations, as well as financial analysis. It is double checked, recalculated and retotaled to ensure that there have been no mathematical or calculation related errors. |

| Completeness | Interest Income across various different investments is clubbed together in order to get a clear cut idea regarding the disclosure that is made in the financial statements. This also requires sampling (if the population size of interest income is considerably large) in order to test if they have been properly mentioned, as well as disclosed in the financial statements. |